Aave (AAVE) Surges in the Crypto Market: Weekend Performance and Future Prospects

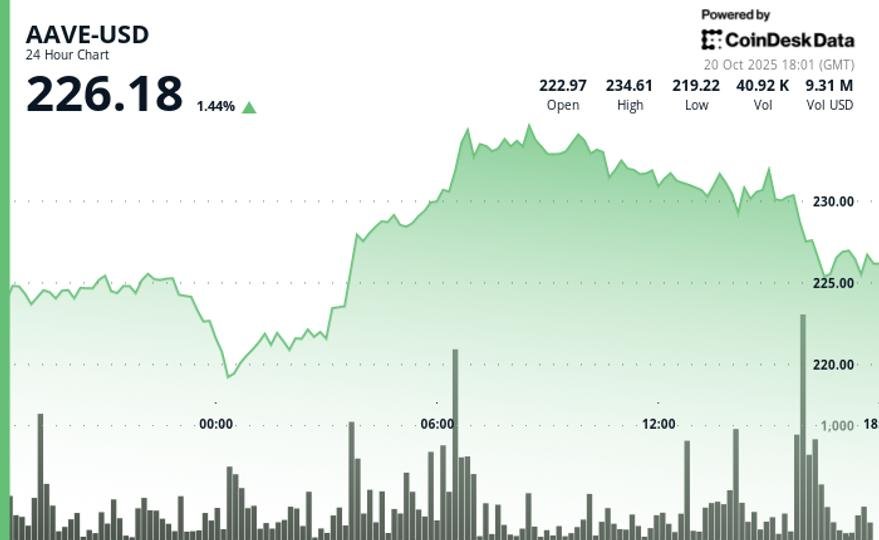

As the cryptocurrency market recovers from Friday’s downturn, Aave’s governance token (AAVE) has emerged as one of the standout performers over the weekend. Priced at approximately $229.09, AAVE saw a notable 10% increase on Monday, temporarily surpassing the $230 mark. This growth is particularly impressive, positioning AAVE just behind Chainlink’s LINK token among the CoinDesk 20 Index members.

Despite a minor pullback, where AAVE’s gains were consolidated around $225, its overall momentum remains bullish. Market analysts have pointed out that AAVE’s upward trend is being sustained, even amidst profit-taking activities among traders. The recent volatility in prices, with multiple attempts failing above the $231 resistance level, suggests a strategic consolidation phase which could indicate future advancements.

Expanding Into Tokenized Asset Lending

Beyond its price performance, Aave is steadily making strides into the burgeoning tokenized asset lending market. The protocol recently announced a collaboration with Grove, a capital allocator linked to Sky (SKY). This partnership aims to facilitate the provision of RLUSD and USDC stablecoins to Horizon, Aave’s new institutional lending platform. In this setup, qualified borrowers will be able to utilize tokenized real-world assets as collateral for loans.

The anticipated integration, which awaits governance approval, is envisioned to enhance liquidity for institutions looking to borrow against various assets, including U.S. Treasury tokens. It’s important to note that Horizon is already operational with collateral options from notable issuers like Superstate and Centrifuge, and relies on Chainlink for valuation data and third-party risk assessments, further ensuring transparency and security within the lending protocol.

Market Sentiment and Technical Indicators

The current sentiment around Aave is quite optimistic as technical indicators show that bullish momentum has remained intact, despite the recent price fluctuations. The overall uptrend has maintained crucial support levels that traders are closely monitoring. Traditional technical analysis highlights that while AAVE faces overhead resistance near $231.00, the token’s ability to stay above this key threshold can attract more investors looking for innovative opportunities in decentralized finance (DeFi).

The resilience shown by AAVE in the face of economic uncertainty is not just a product of its performance; it also reflects broader trends within the DeFi landscape. Investors are increasingly seeking the potential benefits offered through decentralized lending protocols, as they offer transparency and yield opportunities that contrast with traditional finance.

The Role of Governance in Aave’s Growth

Governance plays a pivotal role in shaping Aave’s future. The upcoming integration with Grove will require governance approval, illustrating the community’s central role in the decision-making process. Token holders are empowered to vote on significant proposals that impact the protocol’s evolution and its economic strategies. This democratic process could lead to enhanced innovations and adaptations, further establishing Aave’s competitive edge in the DeFi landscape.

As the community contributes to decision-making, it also promotes a sense of ownership among participants, which can drive further engagement and investment in the protocol. This participative governance model aligns well with the ethos of decentralized finance, fostering transparency and collaboration.

The Competitive Landscape of DeFi

In the fiercely competitive DeFi sector, Aave’s advancements in the tokenized asset lending market position it strategically against its rivals. Major players like Compound and MakerDAO are also seeking ways to enhance their functionalities; however, Aave’s proactive integration of real-world assets could provide a differentiation factor that attracts institutional borrowers.

Tokenization of assets is anticipated to flourish as more traditional financial mechanisms are overlayed with blockchain technology. Aave’s efforts to support and implement these advancements indicate that it is poised to be at the forefront of this innovative shift.

Conclusion: Looking Ahead

As Aave continues to expand its offerings and solidify its position in the DeFi space, stakeholders will be watching closely. The current weekend’s performance is not just a fleeting spike but part of a more profound transformation occurring in decentralized finance.

Ongoing partnerships and governance initiatives are likely to be critical drivers of future success. If Aave successfully implements its plans to leverage tokenized real-world assets, it may not only improve its liquidity pool but also significantly broaden its market appeal. The next few months are crucial for Aave, and the community’s involvement can dictate the protocol’s trajectory, making it a compelling watch point in the cryptocurrency landscape.