XRP Market Update: Navigating Volatility and Potential Resilience

XRP has recently exhibited a narrow trading range after a tumultuous period, managing to stay above key short-term support levels. As traders contemplate their risk exposure, speculation persists that a deeper price correction towards $1.55 could occur before a more significant recovery attempt toward the anticipated $7-$27 price range unfolds.

Current Trends and Price Movements

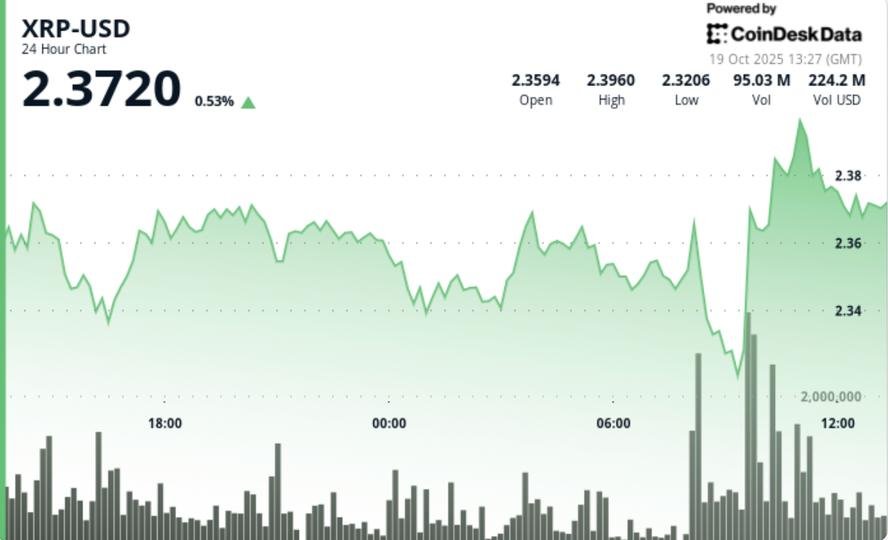

On October 18, XRP showcased impressive activity, rallying briefly to $2.39 with a trading volume of 42.23 million, nearly doubling the average 24-hour volume. However, this surge soon experienced a pullback, consolidating within a tighter range of $2.34 to $2.39. The market remains muted amidst $19 billion in liquidations across cryptocurrencies due to rising trade tensions affecting global markets.

Factors Influencing Market Sentiment

Current market sentiment around XRP is quite cautious, primarily influenced by Ripple’s proposed $1 billion capital raise and the ongoing SEC review of six XRP spot ETF filings. These developments have led institutional traders to adopt a more conservative approach, reducing leverage and transitioning into cash. This shift reflects preparations for upcoming policy announcements and macroeconomic triggers that could impact the broader crypto landscape.

Technical Analysis of XRP’s Price Action

In the October 18-19 session, XRP fluctuated within a compact range of approximately 2%, establishing a support floor at $2.34. The bulls made short-lived attempts to retest the $2.39 resistance, yet sellers quickly resumed control. During the final trading hour, XRP’s slight recovery from $2.34 to $2.35 hinted at the possibility that the previous downturn might have been more of a false break rather than a definitive trend reversal.

Potential Scenarios for Future Movements

Technical indicators suggest a neutral-to-bullish price structure as XRP hovers above $2.34 support. Intraday trading activity indicates an accumulation zone forming within the $2.34 to $2.35 band, with resistance firmly positioned near $2.39. Should XRP manage a decisive break above this level, it could pave the way towards $2.47. Conversely, failing to maintain above $2.34 might expose it to further declines in the $2.28 to $2.31 area, with longer-term projections suggesting a possible 40% correction towards $1.55 if risk-off sentiment grows within the market.

What Traders Are Keeping an Eye On

As we approach October 25, traders are particularly attentive to potential headlines regarding ETF developments, which are anticipated to act as catalysts for increased market volatility. A reclaimed position above $2.40 coupled with solid volume could trigger a bullish phase aiming toward $2.65. Meanwhile, macroeconomic factors, including ongoing U.S.-China tariff discussions and official statements from the Federal Reserve regarding liquidity, are critical in shaping future price directions for XRP.

Conclusion: The Path Ahead for XRP

The current market dynamics surrounding XRP demonstrate a mixture of caution and strategic positioning among traders. As speculative forces weigh heavily following significant technical indicators and market factors, the coming days are set to be essential in determining XRP’s trajectory. Whether it will sustain its current support levels or confront a deeper pullback remains to be seen. Investors and traders must remain vigilant, adaptable to rapid market changes, and informed about both crypto-specific and broader economic developments.