BNB Chain Token Stability and Market Insights

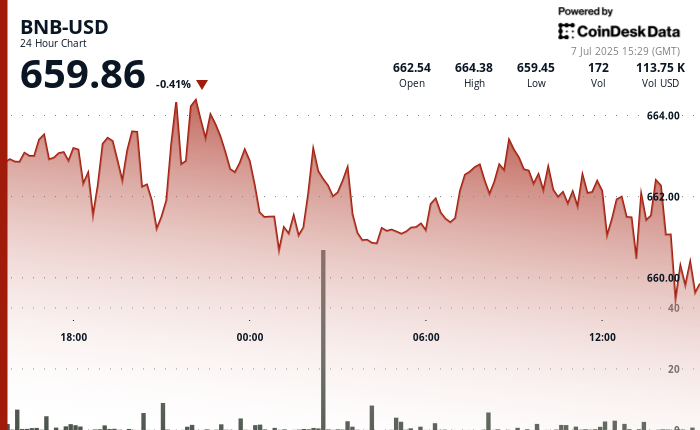

In recent market activity, BNB Chain’s native token has experienced relative stability, maintaining a price near $660 with fluctuations under 1% over the last 24 hours. As BNB trades at approximately $659.61, down by 0.5% in the daily metrics, a pattern of consolidation is becoming evident. Buyer presence is notable around the $659.45 mark, as sellers seem to restrict upward movements beyond the $664.38 threshold. Traders view this price ceiling as a potential launchpad for a breakout, particularly if macroeconomic pressures alleviate.

Market Sentiment and On-Chain Analysis

Current on-chain data reveals mixed sentiments among traders. Funding rates, which represent the fees exchanged between traders in perpetual futures markets, have declined. This suggests a cautious approach from traders, who are opting to hedge instead of chasing Bitcoin’s recent rally that pushed its price above $109,000. The cautious nature of the market could indicate potential volatility in the coming days as traders weigh their options.

Corporate Adoption of BNB

Despite uncertainties in trader sentiments, corporate interest in BNB is on the rise. A notable example is Nano Labs, a chip manufacturer listed on the Nasdaq, which has invested approximately $50 million in BNB. The company aims to acquire up to 10% of the global supply of this cryptocurrency as part of its strategic plans. This level of commitment from established firms highlights the ongoing evolution of institutional adoption within the crypto ecosystem.

Technical Analysis of BNB Price Movements

From a technical analysis perspective, the BNB token’s recent price movements reflect a period of consolidation rather than outright bullish or bearish trends. The presence of competent buyers around critical support levels provides stability, while sellers remain vigilant at the upper boundaries. Traders monitor these price limits carefully, as a sustained break above the $664 threshold could indicate the potential for significant upward movements in the near future.

Macroeconomic Influences on BNB

Macro factors continue to play a critical role in the volatility of cryptocurrency markets, including BNB. Factors such as changes in government regulations, international financial policies, and global economic stability can have profound impacts on trader behavior and market sentiment. If macroeconomic pressures ease, this might create a conducive environment for upward price movements, enhancing the allure for investors and traders alike.

Conclusion: The Future Outlook for BNB

As the cryptocurrency markets grapple with ongoing fluctuations, the stability of BNB Chain’s token offers unique insights into trading behaviors. The combination of buyer confidence at key price points, cautious trading due to funding rate declines, and increased institutional interest creates a complex but potentially rewarding landscape. The future trajectory of BNB will depend significantly on broader macroeconomic trends and further developments in corporate participation.