Chainlink (LINK) Price Drop: An In-Depth Analysis

Overview of Recent Price Decline

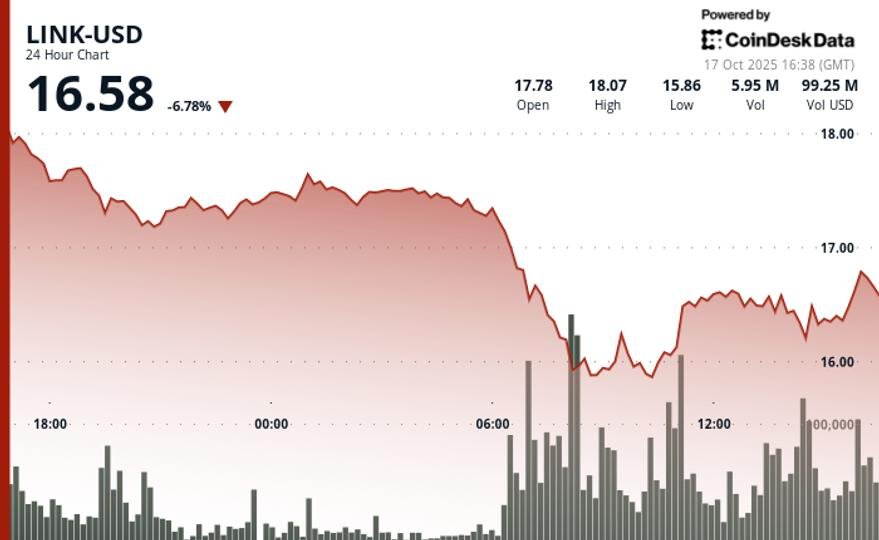

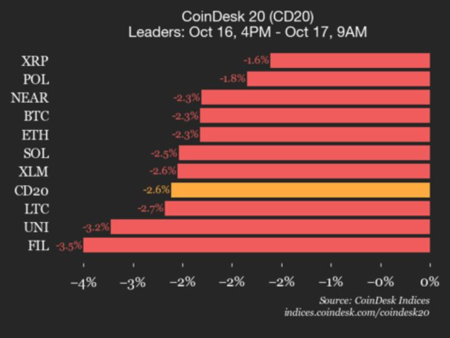

The native token of the oracle network Chainlink, LINK, faced a significant downturn on Friday. The price plummeted nearly 9%, landing at $16.46, the lowest since last week’s widespread cryptocurrency crash. Analytics from CoinDesk Research highlighted that the selling pressure was particularly concentrated during a two-hour window early in the morning. Although LINK made a slight recovery late in the session, rising 0.4%, this small increase was insufficient to recover from the earlier losses.

Corporate Interest Remains Steady

Despite this decline, corporate acquisition activity surrounding LINK has been unaffected. Caliber Corporation, a real estate investment firm listed on Nasdaq, announced a $2 million purchase of LINK, bringing its total holdings to over half a million tokens, valued at approximately $9.2 million based on the current price. This acquisition demonstrates ongoing institutional interest in LINK, a factor that could potentially stabilize its price further down the line.

Chainlink Reserve’s Strategy

Additionally, the Chainlink Reserve added nearly 60,000 LINK tokens to its portfolio, raising its total holdings to 523,159 tokens. However, the reserve is facing significant unrealized losses with its average entry price at $21.98, making its current holdings over 34% underwater. This situation underscores the volatility in the crypto market, emphasizing the need for strategic financial management as prices fluctuate.

Technological Advancements in Chainlink

On the technological front, Chainlink is making strides in its product offerings. The recent launch of Data Streams on MegaETH, a high-speed blockchain tailored for real-time applications, allows smart contracts to access live market data with sub-second latency. This capability is particularly beneficial for decentralized finance (DeFi) applications, including perpetual swaps trading and stablecoins, enhancing Chainlink’s utility and market positioning.

Market Analysis and Price Dynamics

In terms of technical analysis, Chainlink experienced a sharp sell-off, slumping from $18.07 to $16.46. This signifies a trading range of approximately $2.25. The price has established a critical support level between $16.30-$16.35, while institutional buying interest has emerged in the $15.72-$15.82 range. Figureheads in the market are monitoring a resistance level at $17.43, indicating potential future trading strategies.

Conclusion and Future Outlook

Overall, while LINK navigates through a pronounced price decline, the unwavering interest from corporations and advances in technology may offer a buffer against further decreases. Investors and stakeholders are advised to keep an eye on the developing trend lines and upcoming market behaviors. As Chainlink’s strategies unfold, its ability to adapt to market challenges could potentially set the stage for recovery, making it a token of interest for both individual and institutional players in the cryptocurrency landscape.