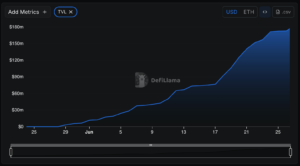

Summarize this content to 2000 words SEO optimized article with 6 paragraphs in English Tokens recently listed on Binance are underperforming compared to the rest of the crypto market, suggesting that price discovery movements are happening on decentralized exchanges. At the same time, traders use centralized platforms to exit liquidity.According to the analyst known by the pseudonym Ignas, the Pudgy Penguins (PENGU) tokens and ChainGPT (CGPT) are the only recent launches that have not experienced a complete crash since their Binance listing. As of press time, PENGU was trading at $0.028, down 60% from the $0.07 price level reached on the day it was listed on the exchange, while CGPT is down 4.7% since its listing on Jan. 10.Meanwhile, the memecoin Simon’s Cat (CAT) and Magic Eden’s native token ME have fallen roughly 70% since their listings.Ignas believes that this is a positive shift for the market:“Previously, price discovery occurred in private VC markets, with CEXs [centralized exchanges] as exit liquidity. Now, DEXs [decentralized exchanges] are for price discovery and CEX for exit liquidity.”He cited Velodrome’s (VELO) listing to further highlight this new dynamic. After Binance created trading pairs for the VELO token on its platform, its price dropped by nearly 70%, currently at $0.1154 as of press time.The reason behind this change is the predominance of traders classified as “smart money” on decentralized exchanges.Moreover, Ignas pointed out that having exit liquidity streams, such as centralized exchanges, is healthy for the market.On-chain activity reaching new peaksIn December, the spot monthly trading volume registered by decentralized exchanges reached a new all-time high of $434.4 billion, beating the previous peak by over $50 billion, as per DefiLlama data.Additionally, a new peak was registered in on-chain derivatives markets in the same month, as these decentralized platforms captured nearly $341 billion in volume.Notably, as of Jan. 13, the proportion of spot monthly trading volume traded in decentralized exchanges was the highest compared to their centralized counterparts.According to the “DEX to CEX Spot Trade Volume” ratio calculated by The Block, DEXs have traded 16% of the total spot volume registered by CEX in January. However, with more than half the month remaining, it’s too early to determine how the ratio will fluctuate over the next two weeks.Mentioned in this article

Related News

Add A Comment

2025 © Crypto News Insiders. All Right Reserved.