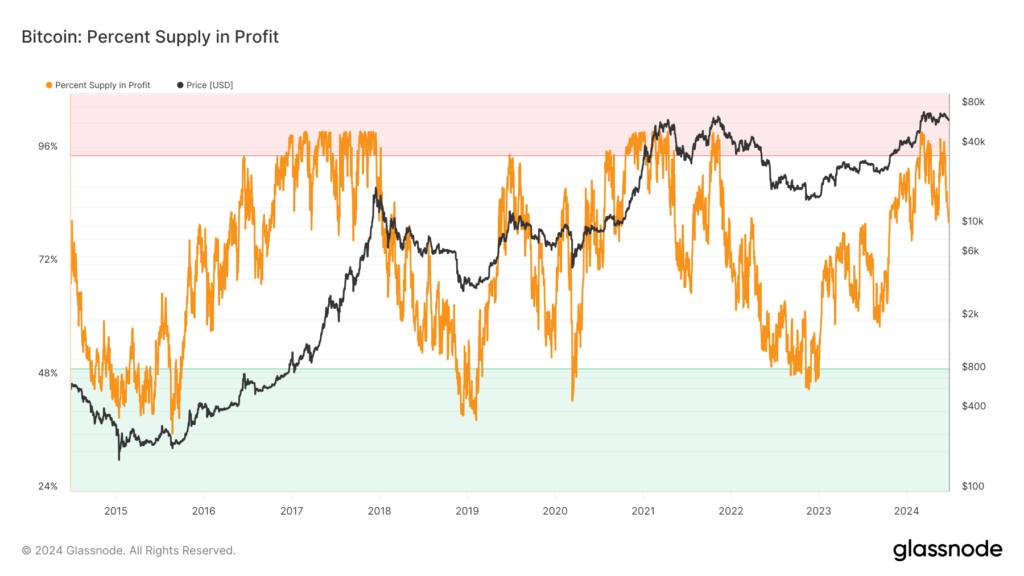

Bitcoin’s supply in profit refers to the percentage of existing coins whose last transaction price was lower than the current market price. This metric reflects the profitability of holding Bitcoin and can provide valuable insights into market sentiment and potential price movements. Historical data from 2013 to 2024 shows that periods of over 90% supply in profit often coincide with significant price rallies, such as those seen in 2017 and late 2020 to early 2021.

However, over the past 12 months, there has been a noticeable decrease in the percentage of supply in profit, dropping from around 100% in March 2024 to 80% by June 2024. This decline has been attributed to the post-halving effects on Bitcoin’s profitability metrics. The drop in supply in profit correlates with a price decrease from nearly $73,000 to around $60,000 during the same period, highlighting the impact of key events like the halving on market dynamics.

The volatility of Bitcoin’s market is evident in these fluctuations, emphasizing the importance of monitoring the percentage supply in profit for traders and investors. Major price changes are often preceded or followed by significant shifts in this metric, making it a useful tool for predicting market trends and making informed decisions. By paying attention to changes in supply in profit, market participants can better understand market sentiment and potentially capitalize on upcoming price movements.

In conclusion, Bitcoin’s supply in profit is a crucial metric for assessing the profitability of holding the cryptocurrency and predicting market trends. Historical data and recent trends demonstrate the cyclical nature of Bitcoin’s market, with periods of high supply in profit often coinciding with price rallies. However, post-halving effects can lead to fluctuations in this metric, as seen in the recent drop from 100% to 80%. By staying informed about changes in supply in profit, traders and investors can gain valuable insights into market sentiment and position themselves for success in the volatile world of Bitcoin trading.