The cryptocurrency market has seen a surge in popularity, with Bitcoin (BTC) and Ethereum (ETH) being two of the most well-known assets in the space. CryptoSlate’s latest market report takes a closer look at the differences between BTC and ETH and how they are traded in the derivatives markets.

When it comes to Bitcoin, it is often seen as a store of value and digital gold. Bitcoin futures have become a major player in the derivatives market, allowing traders to speculate on the future price of the cryptocurrency. In addition to futures contracts, Bitcoin also has options and perpetual futures markets, which offer even more ways to trade the asset.

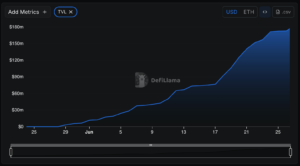

On the other hand, Ethereum is known for its smart contract capabilities and decentralized applications. While Ethereum also has futures and options markets, they are not as widely used as Bitcoin’s. However, Ethereum’s decentralized finance (DeFi) ecosystem is growing rapidly, opening up new opportunities for traders to participate in the market.

When comparing the two assets, Bitcoin tends to be more stable and less volatile than Ethereum. This makes it a more attractive option for conservative traders who are looking for a safe haven asset. On the other hand, Ethereum’s volatility can offer higher returns for those willing to take on more risk.

In conclusion, both Bitcoin and Ethereum offer unique opportunities for traders in the derivatives markets. Bitcoin is seen as a store of value, while Ethereum’s smart contract capabilities make it a valuable asset for decentralized applications. As the cryptocurrency market continues to evolve, it will be interesting to see how these two assets continue to compete and complement each other in the derivatives markets.