A recent report by Pantera Capital highlights Solana’s potential to become a dominant player in the blockchain ecosystem, drawing parallels between its monolithic architecture and Apple’s macOS. The report, authored by General Partner Franklin Bi, Portfolio Manager Cosmo Jiang, and Investment Analyst Eric Wallach, delves into Solana’s rising influence and its implications for the future of blockchain technology. According to the report, the blockchain ecosystem is expected to converge around a few dominant platforms driven by developer preferences, and Solana’s integrated approach is poised to capture a significant share of this consolidation. Developers are considered the “root” of the blockchain ecosystem, shaping crypto broadly and acting as customers who build applications that drive blockspace demand, leading to a potential oligopoly of chains similar to Windows, MacOS, and Linux in the desktop computer market.

Solana’s monolithic design offers a seamless user experience, faster innovation, and enhanced security, making it an attractive choice for developers and end-users alike. Solana’s capabilities are enabling innovative applications across various sectors, from content distribution and decentralized mapping to capital-efficient financial markets. While Ethereum has historically been the leading platform for blockchain development, commanding 70-80% of developer activity, Solana is rapidly gaining ground, according to the report. The rise of Solana is compared to Apple’s breakthrough against Microsoft in the early desktop computer market, with its monolithic architecture serving as a key differentiator. This approach allows the network to optimize every component of its blockchain, offering significant benefits over modular blockchains like Ethereum and Cosmos.

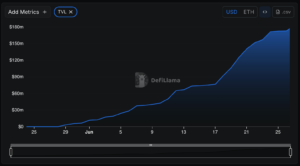

Solana has seen growth in various categories, with a unique address count rising from 14,000 in October 2020 to 1.34 million as of March. Priority fees have also increased from $100,000 monthly in mid-2023 to $60 million in March, indicating a high demand for block space on Solana. The network accounted for 85% of all new tokens on DEXs in May, up from 50% a year ago, driven by the “explosive growth” in memecoin activity. The network’s share of DEX volumes has grown from 0% in early 2021 to 24% in May, capturing over 60% of incremental DEX volume during the month. The top wallet on the network, Phantom, briefly rose to the top spot in various iOS app store categories, becoming the most downloaded app in late May and early June, a sign of mainstream adoption and related to the memecoin trading boom.

Solana’s total economic value, including transaction fees and maximum extractable value (MEV), has surpassed 32% of the same metric on Ethereum. This trend has a real economic value capture for SOL token holders, attracting stakers and improving decentralization and security. Pantera Capital’s report highlights Solana’s rapid growth and potential to become a dominant player in the blockchain ecosystem, driven by its monolithic architecture and innovative capabilities. As developers continue to shape the future of blockchain technology, Solana’s integrated approach and seamless user experience position it well to capture a significant share of the market consolidation expected in the blockchain space.