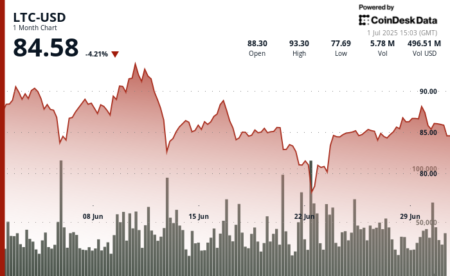

The Bitcoin market has been facing fluctuations and challenges in recent days, with the bulls potentially losing ground to the bears. On June 24th, Bitcoin experienced a 7.84% loss, sparking concerns about the impact of Mt. Gox repayments on the cryptocurrency’s value. There were predictions of a sharp price drop, which indeed occurred as Bitcoin fell to $58.4k before rebounding to $61.1k. The support zone around $59k-$60k is crucial in determining whether Bitcoin will maintain its current range or face further declines.

As Bitcoin struggled to recover from its recent losses, the crypto market observed a downward trend in prices. Despite a brief bounce from $66k to $66.9k on June 16th, Bitcoin soon fell to $59.7k, testing the support zone. The daily RSI indicator suggested a potential recovery, with a value of 30.38 at press time compared to a low of 25.6 on Monday. However, the OBV indicator signaled strong selling pressure, indicating a need for a reversal in the trend for the bulls to regain confidence.

While the $59k region has historically been a strong demand zone, recent liquidation data suggests that further price drops may be imminent. Analysis of the liquidation data from Hyblock indicated a likelihood of another 10% decrease in Bitcoin’s price. The concentration of long liquidations around the $55k mark on the six-month chart suggests that this level may act as a magnet for prices before a potential uptrend can resume. Traders and investors are advised to remain vigilant and consider buying opportunities at the $55k level rather than panicking and selling hastily.

In conclusion, the Bitcoin market is facing uncertainty as the bulls struggle to maintain control against the bears. The support zone around $59k-$60k will play a critical role in determining the cryptocurrency’s future trajectory. While indicators like the RSI show potential for a recovery, the strong selling pressure reflected in the OBV indicator poses a challenge for bulls. Traders should be cautious of further price drops and consider buying opportunities at the $55k level as a potential entry point. Disclaimer: The information presented is based on the writer’s opinion and should not be considered financial advice.