Ripple’s XRP Trading Performance in Q1 2023: A Detailed Analysis

In the first quarter of 2023, Ripple’s XRP demonstrated significant trading activity on top-tier exchanges, registering an average daily volume (ADV) of nearly $3.2 billion. Despite a decline in activity on the XRP Ledger (XRPL), both institutional and retail investor engagement remained stable. This article delves into the trends and shifts in XRP trading volume, showcasing the dynamics that shaped its market performance during this period.

Trading Volume Overview

XRP’s trading volume highlighted its robust presence in the cryptocurrency market, particularly with substantial spikes observed in late January and early February. Daily trading volumes soared beyond $16 billion at peak times, reflecting heightened engagement among traders. As the quarter progressed, trading activity tapered off; however, Binance continued to dominate, capturing around 40% of total trading volume across exchanges. Other notable exchanges like Upbit (15%) and Coinbase (12%) also contributed significantly, while Bybit’s activity waned due to a platform hack. This trading environment underscores XRP’s resilience and its strong position among major cryptocurrencies.

Trading Behavior and Pair Composition

Analyzing XRP’s trading behavior reveals a distinct preference for stablecoin pairs, predominantly USDT. Interestingly, the share of trading involving fiat pairs grew slightly from 25% in the last quarter of 2022 to 29% in Q1 2023. This shift indicates a subtle move toward more traditional currency tools as traders navigate the crypto landscape. The data illustrates XRP’s liquidity and preference for stablecoin markets, allowing it to outperform several other altcoins, including Cardano (ADA) and Solana (SOL). By the end of the quarter, XRP was trading at $2.09, with its ADV trailing only behind Bitcoin (BTC) and Ethereum (ETH).

Price Volatility and Performance

The volatility surrounding XRP was significant in Q1, with the price trajectory showcasing remarkable fluctuations. Starting off below $2.00, XRP surged to a multi-year high of $3.40 in early February, only to retreat to $2.09 by the end of March. This volatility was evident in XRP’s realized price fluctuations, beginning the year at 150% and stabilizing around 130% through the quarter. Factors such as anticipated regulatory clarity and product expansions initially fueled the price rise, whereas profit-taking and broader market adjustments led to the subsequent decline. Notably, XRP finished the quarter with an impressive 89% increase in its average closing price from the previous quarter.

On-chain Metrics Contraction

While trading volume on exchanges showcased resilience, on-chain metrics related to the XRPL exhibited a downturn, reflecting trends in the broader cryptocurrency market. Overall transactions fell by more than 37% to 105.5 million, with wallet creations declining by 40% to 423,727. Coinciding with reduced on-chain activity, the XRP burned as transaction costs decreased by 31%. The rise in average transaction costs in dollar terms, however, highlights the impact of the token’s price appreciation. Despite these setbacks, decentralized finance (DeFi) activities on the XRPL demonstrated more stability, with decentralized exchanges witnessing a mere 17% decline in volumes.

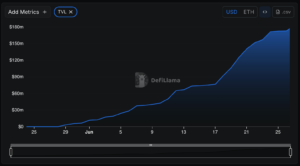

DeFi Resilience and Future Outlook

Despite the overall contraction in on-chain activities, Ripple’s foray into decentralized finance remained relatively robust. The introduction of RLUSD, Ripple’s USD stablecoin, achieved a market cap exceeding $90 million with cumulative decentralized trading volume surpassing $300 million. This resilient performance in the DeFi sector suggests that investor demand for XRP is being buoyed by short-term trading interests, indicating a healthy appetite among traders for liquidity and market opportunities.

Conclusion

In summary, Ripple’s XRP showcased remarkable trading performance in Q1 2023, marked by substantial trading volumes and notable price fluctuations. While on-chain activity showed signs of decline, the resilience of XRP in trading and decentralized finance sectors offers promising insights into its future trajectory. As the marketplace evolves and regulatory clarities develop, XRP may continue to attract significant interest, indicating a potential bright spot in the cryptocurrency landscape. This analysis illustrates how XRP not only competes effectively among its peers but also adapts to changing market dynamics, positioning itself as a key player in the crypto realm.