Coinbase Q1 Financial Overview: A Solid Growth Trajectory

Coinbase, a leading cryptocurrency exchange, reported an impressive $2 billion in total revenue for the first quarter of the year, marking a significant increase from $1.6 billion in the same period in 2024. This surge in revenue underscores Coinbase’s ability to adapt to the evolving digital asset landscape. However, the exchange’s net income of $66 million presents a stark contrast to the $1.2 billion reported last year, which included substantial unrealized gains. Despite this decline in net income, the adjusted EBITDA for the quarter was a robust $930 million, with adjusted net income reaching $527 million, signaling that the company continues to thrive amidst market fluctuations.

One notable area of growth for Coinbase is its subscription and services revenue, which rose by 9% quarter-over-quarter to reach $698 million. This increase indicates a growing user demand for non-trading income sources, reflecting a strategic shift in how users are engaging with the platform. The emphasis on subscription services is a clear indication that Coinbase is diversifying its revenue streams beyond traditional trading fees, thereby appealing to a wider audience of crypto enthusiasts and investors.

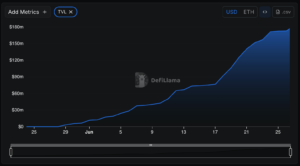

Furthermore, Coinbase showcased a solid liquidity position with $9.9 billion in USD resources, encompassing cash, cash equivalents, and USDC holdings. The growth in average assets under custody, which increased by $25 billion during the quarter, emphasizes the trust institutional and retail investors have in the platform. Coinbase’s commitment to safeguarding user assets has been a pivotal factor in attracting new investors and maintaining the confidence of existing ones.

In terms of trading dynamics, Coinbase processed a staggering $315 billion in institutional trading volume during the first quarter. This figure was complemented by a $25 billion increase in average assets under custody, solidifying Coinbase’s reputation as the preferred platform for institutional traders. The addition of 39 new perpetual contracts on its international exchange (INTX) contributed to a global derivatives trading volume surpassing $800 billion, showcasing the exchange’s expanding suite of advanced financial instruments aimed at active crypto traders.

Looking towards the future, Coinbase is set to release its full 10-Q filing with the SEC on May 9. This document will provide a detailed reconciliation between GAAP and non-GAAP metrics utilized in its earnings presentation, allowing investors and analysts a clearer view of the company’s financial health and operational strategies. The anticipation surrounding this report highlights the confidence stakeholders have in Coinbase’s transparent and forthright approach to business.

Institutional engagement appears to be a promising segment for Coinbase, with 86% of surveyed institutional investors indicating they either currently hold digital assets or plan to make allocations in the coming year. Additionally, stablecoins have emerged as a crucial growth segment for the platform. The average USDC balance in Coinbase’s products skyrocketed by 49% quarter-over-quarter to an impressive $12 billion, while USDC revenue increased by 32%. The growing adoption of stablecoins signifies a shift in market dynamics, benefiting Coinbase as it strengthens its foothold on the Ethereum Layer 2 network, Base.

In conclusion, Coinbase’s first-quarter performance illustrates the company’s commitment to expanding its offerings and adapting to the ever-changing cryptocurrency market. With robust revenue growth, an increasing focus on subscription services, and a solid standing in stablecoin transactions, Coinbase continues to be a formidable player in the digital asset space. As institutional interest grows and trading volumes rise, Coinbase is well-positioned to maintain its leading role, further solidifying its status as the platform of choice for traders and investors alike.