Circle Goes Public: A Milestone for Crypto and Traditional Finance

On June 5, 2023, Circle, the issuer of the USDC stablecoin, made waves in the financial world by officially debuting on the New York Stock Exchange (NYSE) under the ticker symbol CRCL. This pivotal move positions Circle as one of the only major crypto-native companies to successfully transition into a publicly traded entity through conventional listing channels. The firm’s journey from a startup to a public company marks a significant achievement, indicating the growing acceptance of cryptocurrency companies in traditional finance.

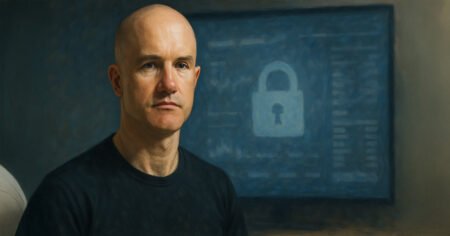

Circle’s CEO, Jeremy Allaire, emphasized the importance of transparency and regulatory compliance with this transition. He stated that aligning with the standards of both the NYSE and the SEC reflects the company’s core values of trust, ethics, and governance. “Twelve years ago, we set out to build a company that could help remake the global economic system,” Allaire stated. He expressed the company’s ongoing mission to foster global economic prosperity through seamless value exchanges, underscoring the revolutionary vision behind Circle’s inception.

Investor enthusiasm surrounding Circle’s IPO was particularly notable, with the firm raising over $1 billion—significantly surpassing its initial projections of $896 million. This impressive figure not only highlights institutional interest but serves as a validation of Circle’s business model and future potential. Early trading data listed the opening price of Circle’s shares at $31, with analysts like VanEck’s Matthew Sigel forecasting a potential trading range between $42 and $44. Such positive indicators reflect a strong market position and increasing demand for shares in the crypto sector.

Market analysts have characterized Circle’s IPO as a remarkable success, noting that it was 25 times oversubscribed. This substantial demand signals Wall Street’s readiness for more digital asset IPOs, which could pave the way for additional cryptocurrency firms to make similar transitions. Kevin Callahan, co-founder of Uniblock, remarked that this overwhelming interest is a bullish sign for the entire crypto industry, indicating a shift toward mainstream acceptance. The demand for Circle’s offerings could inspire other firms in the space to explore public listings, further integrating crypto into the financial ecosystem.

Circle’s regulatory-first approach sets it apart in a space often scrutinized for compliance issues. The company operates as one of the few licensed digital asset firms across multiple jurisdictions, including New York, Singapore, and Europe. This commitment to regulatory standards not only enhances Circle’s credibility but positions it advantageously as stablecoins garner increased attention from traditional financial institutions. Brian Armstrong, CEO of Coinbase, echoed this sentiment, recognizing Circle’s pioneering efforts to build legitimate, regulated crypto products in a challenging environment.

In conclusion, Circle’s public listing on the NYSE marks a significant milestone for both the company and the wider cryptocurrency landscape. As one of the first major crypto-native firms to navigate the complexities of a traditional IPO, Circle sets a precedent for future opportunities in digital asset markets. This successful transition underscores the increasing convergence of cryptocurrency and traditional finance, paving the way for enhanced credibility and trust in the crypto industry. With strong institutional interest and a commitment to regulatory compliance, Circle is well-positioned to lead the charge toward a more integrated financial future.