Recent Trends in Bitcoin Inflows at Binance: A Comprehensive Analysis

Binance, one of the leading cryptocurrency exchanges, has recently reported a significant decline in its monthly Bitcoin (BTC) inflows. Currently, inflows have dropped to 5,700 BTC, a stark contrast to the average of 12,000 BTC recorded since 2020. This figure is even more telling when compared to the 24,000 BTC that flowed into the exchange during the tumultuous FTX crisis of late 2022. According to CryptoQuant analyst Darkfost, this downturn in inflows signals a notable shift in market dynamics, particularly the selling behavior of cryptocurrency holders.

Analyzing Deposit Patterns and Market Behavior

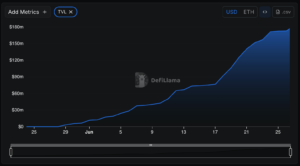

Data from Darkfost indicates that historically, substantial deposit spikes on Binance have coincided with local price peaks. For instance, during the significant price corrections last August, inflows surged beyond 17,000 BTC, and again surpassed 20,000 BTC in March when Bitcoin first hit the six-figure mark. These spikes often foreshadowed short-term price declines. Consequently, Binance has emerged as a critical platform where Bitcoin holders convert potential selling intentions into actual market supply.

The recent figure of 5,700 BTC, arriving at a time when Bitcoin has stabilized above $105,000 and exhibited low volatility, further emphasizes the current trend of reduced trading activity. Interestingly, this latest inflow represents about 30% of the 13,200 BTC that reached the exchange when Bitcoin first crossed the $100,000 threshold in December 2024. These patterns illustrate a potential holding phase among traders, wherein both retail investors and larger groups are holding their coins, thus alleviating immediate selling pressure.

Implications of BTC Response on Market Supply and Demand

The decline in Bitcoin deposits signifies that fewer coins are poised for near-term liquidation. Typically, traders deposit Bitcoin to exchanges when they plan to sell, so a reduction in inflows suggests a shift in sentiment. When the supply on order books decreases and demand remains constant, the potential for upward price movement increases. This pattern has been supported by Glassnode’s observations in May, which reported a cooling of “Binance sell pressure” during Bitcoin’s ascent towards $104,000.

Understanding Binance’s Role in Centralized Exchange Activity

Binance commands a significant portion of the cryptocurrency market, accounting for approximately 37% of the monthly centralized exchange trading volume in 2023, as noted by The Block. Given this preeminence, trends in Binance’s deposit activity serve as an important indicator of broader market intentions. Darkfost’s focus on inflows rather than outflows allows for a clearer analysis of selling strategies, considering that an uptick in deposits signals an active decision to sell, while withdrawals often reflect long-term storage or custodial preferences.

The methodology applied by Darkfost smoothed the inflow data using a monthly mean to mitigate sudden fluctuations caused by macroeconomic events, such as geopolitical tensions. Even after adjusting for these variables, the current inflow figure is the lowest recorded in over four years, underscoring a pivotal moment for the cryptocurrency market.

Caution Against Potential Market Shocks

While the current low inflow levels might seem positive for ongoing price stability, Darkfost warns of the inherent risks associated with macroeconomic uncertainty and low liquidity. Should any unexpected events lead to a spike in deposits, the market could experience volatile reactions. Darkfost advises closely monitoring any increases toward the long-term average of 12,000 BTC as an alert for possible renewed selling activities.

Conclusion

In conclusion, the latest trends in Bitcoin inflows at Binance indicate a broader strategy among holders to maintain their assets rather than liquidate them. This behavior may signal a maturing market where traders are becoming more selective about when to sell. Investors and analysts alike should keep an eye on Binance’s inflow and outflow data, as it can serve as a barometer for market sentiment and potential price movements in the volatile cryptocurrency landscape. The current trend of reduced inflows may serve as a buffer against immediate sell pressure, but it is essential to stay alert for any shifts in trading patterns that could herald a return to more active market conditions.