Exploring the Future of WLFI and the USD1 Stablecoin: Trends in Corporate Treasury Strategies

At a recent conference in New York, Zak Folkman, co-founder of World Liberty Financial Inc. (WLFI), addressed the rising interest from public companies in utilizing WLFI as part of their corporate treasury strategies. This shift aligns with a broader industry conversation regarding the increasing role of crypto assets in diversifying corporate balance sheets. As companies look for innovative ways to manage their financial resources, WLFI’s offerings have captured attention, hinting at a fundamental change in how businesses approach treasury management.

The firm recently introduced an integrated mobile app aimed at simplifying access to its services, including the governance features of the USD1 stablecoin. This app not only facilitates user engagement but also enhances the overall experience of interacting with WLFI’s financial tools. Folkman emphasized the significance of this development, stating that “everyone who wants to know WEN World Liberty (Financial)… is going to be very very happy,” suggesting imminent updates that could excite potential users and investors alike.

In tandem with these developments, WLFI is set to release the first audit of its USD1 stablecoin, reinforcing its commitment to transparency and accountability. Conducted by an independent accounting firm, this audit will provide an essential layer of trust for users and investors, particularly in a sector that has been plagued by skepticism regarding regulatory compliance and financial integrity. Folkman stated, “We’re going to have very transparent auditing from a financial level,” signaling a proactive stance on transparency, which is often not prioritized among stablecoin issuers.

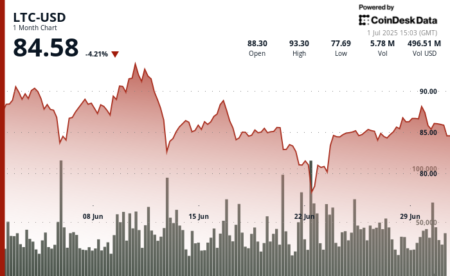

Despite occasional fluctuations, the USD1 stablecoin has demonstrated remarkable stability, largely maintaining its peg to the U.S. dollar throughout June. According to data from CoinGecko, the stablecoin experienced a few brief dips below $0.99 and spikes above $1.04, which are common price variations for newer stablecoins. However, USD1 quickly reverted to its intended value, showcasing its resilience in the often volatile stablecoin market. This performance indicates a robust mechanism behind its pricing, which likely reassures both investors and users.

With over 2.1 billion USD1 tokens currently in circulation, the forthcoming audit underlines WLFI’s commitment to a transparent operational model. While CoinGecko has yet to update its market cap data, DefiLlama listed USD1’s valuation at approximately $2.201 billion, hinting at substantial momentum within the WLFI ecosystem. As interest builds in WLFI’s offerings, the projected audit could serve as a catalyst for attracting further investment and user participation, especially from institutions that may feel reassured by the proactive steps taken toward transparency.

In conclusion, the synergy between WLFI’s innovations—like its mobile app and forthcoming audit—reflects a broader trend towards transparency and accountability in the crypto space. As public companies contemplate integrating crypto assets into their treasury strategies, WLFI seems poised to capture a significant share of this emerging market. With the USD1 stablecoin proving its stability and the company committed to transparent operations, the future of WLFI appears promising as it navigates the evolving landscape of digital finance.