Joe Lubin’s Strategic Vision for Sharplink Gaming: Navigating the Ether Market

Joe Lubin, the co-founder of Ethereum and a significant player in the blockchain space, is redefining financial strategies at Sharplink Gaming. Recently repositioned as an Ether treasury firm, Sharplink is looking to leverage its Ether holdings while maintaining a stable operational framework. This move comes on the heels of a significant $425 million private placement deal, led by Lubin’s other venture, Consensys, aimed at acquiring Ether and bolstering the company’s financial position.

Understanding Sharplink’s Transition

Sharplink Gaming has made headlines with its bold strategic pivot into the Ether treasury realm. Lubin, during a recent interview with Bloomberg Television, revealed that the company is exploring various financial instruments such as convertible equity and long-term bonds to facilitate this transition. This approach aims to enhance Sharplink’s Ether assets without exposing the company to undue risk. The private placement initiated by Consensys was met with initial investor excitement, causing an uptick in Sharplink’s stock, but soon after, a standard market correction led to a substantial drop.

Stock Performance: Managing Expectations

Shortly after the announcement of the Ether acquisition deal, Sharplink experienced a staggering 69% decline in stock price following the registration of investor shares. Lubin characterized this stock drop as a typical market response and emphasized that it shouldn’t raise alarms. He cited that many investors who were keen to invest in the private placement missed the deadline, creating a volatile reaction in stock prices. Understanding such market dynamics is crucial for investors and stakeholders as they navigate the crypto landscape.

Inspiration from Michael Saylor’s Model

Lubin’s vision is not just a whimsical shift but is inspired by successful strategies seen in the broader cryptocurrency industry. He specifically referenced Michael Saylor, the CEO of Strategy (formerly MicroStrategy), who pioneered the idea of leveraging corporate treasury assets to invest in Bitcoin. Saylor’s approach yielded remarkable returns and has since inspired other firms to consider similar strategies. Lubin believes that Ethereum presents an even greater long-term potential than Bitcoin, citing its capacity to underpin a diverse ecosystem of applications, tools, and decentralized finance solutions.

Ethereum vs. Bitcoin: A Comparative Outlook

Despite Lubin’s optimistic view of Ethereum’s future, market performance data suggests it has faced challenges compared to Bitcoin. While Bitcoin saw a 15% increase year-to-date, Ether’s value dropped by 27%, even after a recent recovery. Lubin argues that this disparity arises from market misconceptions surrounding Ethereum’s utility and potential. He insists Ethereum represents the next evolution in digital infrastructure, positioning it favorably for long-term gains as the market matures.

Sharplink’s Future and the Ether Strategy

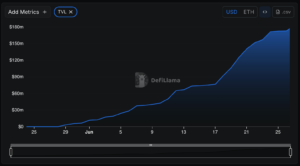

Sharplink’s pivot into Ether treasury strategies underscores a broader trend of companies seeking to effectively diversify their assets through blockchain technology. As the financial landscape continues to evolve, Sharplink could emerge as a prominent player in Ether-based financial strategies. With Ethereum’s current price hovering around $2,431.66 and showing signs of slight recovery, the calculus for investing in Ether is becoming increasingly attractive to firms considering similar strategic pivots.

Conclusion: A New Era for Crypto Treasury Firms

As Sharplink Gaming adapts its business model under Lubin’s guidance, the company may stand at the forefront of a new phase in cryptocurrency financial strategy. Leveraging the insights gained from established models and embracing the untapped potential of Ethereum could position Sharplink as a leader in the burgeoning world of digital treasury management. As the cryptocurrency market matures, companies like Sharplink will likely continue to play a pivotal role in shaping the future of finance.