Bitcoin Price Dynamics: Analyzing Current Trends and Future Projections

Bitcoin (BTC) has recently been caught in a perplexing phase, oscillating between $100K and $110K despite a surge in demand. The ongoing speculation surrounds whether the cryptocurrency is experiencing price suppression, which has led to diverse opinions within the crypto community. Notably, venture capitalist Chamath Palihapitiya boldly predicted that Bitcoin could reach $500K by October, sparking discussions about the underlying factors affecting BTC’s price movement.

Understanding Price Suppression in Bitcoin

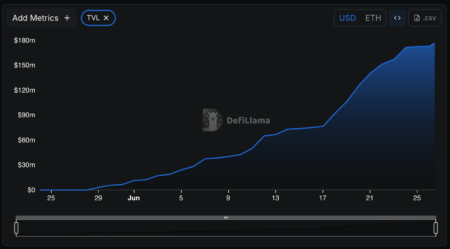

The question of price suppression has been prevalent on social media platforms like Crypto Twitter. Many enthusiasts are struggling to reconcile the increasing positive momentum—largely driven by substantial ETF inflows and investment from treasury firms—with Bitcoin’s range-bound price. In the second quarter of this year alone, ETF inflows increased dramatically, totaling nearly $11 billion. Furthermore, firms like Metaplanet and Twenty One Capital have made headlines with their multibillion-dollar Bitcoin purchases. This seemingly insatiable appetite for Bitcoin begs the question: why is the price remaining relatively stagnant?

The Role of Long-Term Holders

Charles Edwards, founder of Capriole Investment, offers insight into this phenomenon, attributing it to selling pressure from long-term holders (LTHs). He states that these Bitcoin "OGs" have been selling their holdings on Wall Street since the ETF launch in January 2024, an action contributing significantly to the current market dynamics. A striking observation is the recent behavior of 6-month holders, whose numbers have surged, suggesting they are absorbing some of the bearish pressure while LTHs continue to offload their assets.

Market analysts have noted a stark contrast: while new investors seem eager to buy, older investors are liquidating their positions. This behavior creates an unusual dynamic, complicating the relationship between demand and price.

The Over-the-Counter (OTC) Market Impact

While conventional trading platforms (CEXs) often trend towards reflecting market price fluctuations, it’s essential to consider over-the-counter (OTC) transactions, which can obscure actual demand signals. Analysts from TXMC Trades have observed that large buys are increasingly being executed through OTC desks. These transactions are less likely to influence the price directly, meaning that while demand from ETFs is rising, its market impact may be muted because it is not immediately visible on standard trading platforms.

Additionally, a concerning trend has emerged: the supply of Bitcoin on OTC desks and reserves on centralized exchanges has decreased by 20-30% since 2024. This decline could set the stage for a price squeeze in the future—a scenario where constraining supply coupled with persistent demand could drive prices much higher.

Whale Dynamics and Their Influence

The behavior of Bitcoin whales is another critical element influencing price. Long-held Bitcoin by whales—specifically those holding over 10K BTC—has been continually sold off since 2017, according to analyst Willy Woo. Notably, these whales initially acquired their BTC at prices ranging from $0 to $800, benefitting from early investments. The number of whales holding over 1,000 BTC also saw a decline from 2,114 in late May to 2,008, coinciding with Bitcoin peaking at $111K in May. This indicates a potential transitional phase as large holders re-evaluate their positions amid changing market conditions.

Retail Interest and Market Sentiment

In addition to whale behaviors, retail interest has diminished by approximately 10% during this period, further hindering Bitcoin’s potential price breakout. The drop in retail engagement suggests a lack of confidence or awareness, which could stifle any groundswell supporting a price rally.

Despite these market inconsistencies and pressures, Chamath Palihapitiya’s prediction of a $500K Bitcoin by October continues to resonate with some analysts and investors, especially when considering historical price movements following Bitcoin’s halving events.

Conclusion: The Road Ahead for Bitcoin

As Bitcoin navigates an environment characterized by considerable buying from ETFs yet concurrent selling from long-term holders, the market’s future trajectory remains uncertain. While macroeconomic factors, long-term holder behaviors, and OTC transaction activities are crucial indicators, they collectively paint a picture that could either see Bitcoin surge toward uncharted territories or remain constrained in its current price range. The coming months will be critical in determining whether Palihapitiya’s bold prediction holds any merit and how Bitcoin will react as market conditions evolve.

In a world where the digital asset landscape is continuously changing, understanding the multifaceted dynamics of Bitcoin is essential for investors, traders, and enthusiasts alike.