Understanding Optimism’s Current Market Activity: An Analysis of Recent Trends

In recent weeks, Optimism (OP) has showcased significant developments in its blockchain ecosystem, particularly concerning daily active addresses. Impressively, the platform has witnessed a 28% increase in these addresses, with an additional 9.9% rise reported over the past week, according to data from IntoTheBlock. Notably, a spike in user activity was recorded on June 27, marking a pivotal moment for the platform. This increase in daily active users reflects a budding interest in Optimism, positioning it for potential growth amid the prevailing market conditions.

However, despite these rising activity levels, selling pressure around OP remains a prominent concern. The On-Balance Volume (OBV) metric supports this observation, indicating that the selling volume has consistently outpaced buying volume throughout recent months. The market’s dynamics have thus skewed bearish, with OP struggling to maintain upward momentum. These contrasting elements of user engagement and selling pressure underline the complex nature of the current market climate for Optimism.

Whale Concentration and Market Impact

A closer analysis of Optimism’s supply distribution reveals intriguing insights about its ecological structure. Approximately 60% of OP tokens are concentrated within whale wallets, while 23.8% are held by smaller investors who own between 0.1% and 1% of the total supply. This significant concentration among whales raises concerns about decentralization and the potential influence these large holders have on market prices. The low percentage of retail holders indicates that a broad adoption of Optimism might face hurdles, given that a smaller number of investors possess the ability to wield considerable power over market movements.

Interestingly, while the whale cohort holding between 1M and 10M OP tokens has been actively accumulating, with their holdings increasing by nearly 50M OP since June 1, the group controlling between 10M and 100M OP has, in contrast, liquidated approximately 43M OP from their wallets. This divergence in behavior highlights the complexities within Optimism’s market and the ongoing struggle against significant selling pressure.

On-Chain Activity vs. Whale Accumulation

The contrast between high on-chain activity and subdued whale accumulation suggests that Optimism may grapple with a potential market recovery. On-chain metrics indicate a growing user base; however, the lack of noticeable accumulation from large holders paints a cautious picture regarding future price stability. The persistent bearish sentiment since January compels market observers to assess whether this uptick in activity can translate into meaningful price recovery or if it’s merely a fleeting moment in an otherwise struggling market.

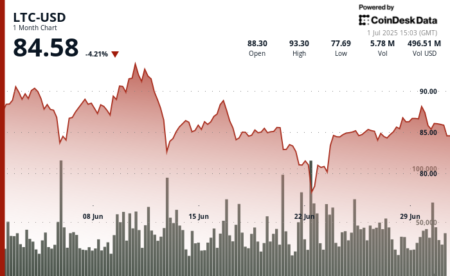

Identifying Market Trends: Bearish Indicators

The market trends for OP remain predominantly bearish, as evidenced by the ongoing decline in OBV metrics since March. This pattern indicates that sell pressure has continued to overshadow buying pressure, particularly on days when the market does show a semblance of green. The Supertrend indicator reinforces this bearish momentum, consistently signaling a sell, further substantiated by moving averages that reflect negative market sentiment.

Despite ongoing bearish trends, there are glimmers of hope for short-term bullish traders. Recent developments indicate a potential bullish market structure break, hinting at a lower timeframe demand zone sitting at around $0.56. This could present an opportunity for traders seeking to capitalize on short-lived upward movements, although they must navigate the underlying bearish trend with caution.

Strategic Trading Amidst Volatility

For traders contemplating taking a long position in OP, the prevailing market conditions necessitate tight strategic stop-loss placements. The risk of significant downward movement remains high, suggesting that while opportunities exist, they should be approached with careful risk management. Entering the market without a solid plan could lead to adverse outcomes, especially in a landscape characterized by whale dominance and market volatility.

In conclusion, while recent increases in daily active addresses and on-chain activities signal growing interest in Optimism, the overwhelming selling pressure and whale concentration need to be carefully evaluated by investors. As the market navigates through these complexities, prudent trading strategies, and a keen understanding of both the macro and micro factors at play are crucial for those looking to engage with Optimism moving forward.

Disclaimer: The information presented does not constitute financial, investment, or trading advice and is solely the opinion of the author. Always conduct thorough research and consult with professionals before making investment decisions.