Ripple’s RLUSD: A New Era in Stablecoins

Ripple has taken significant strides in the stablecoin landscape by minting an additional 16 million RLUSD, its dollar-backed stablecoin. This move has increased the total circulating supply of RLUSD, signaling robust demand within the stablecoin market. Ripple’s treasury minting is seen as a pivotal moment, showcasing the growing interest in digital assets backed by tangible reserves and reliable technology.

AMINA Bank’s Historic Support

In a ground-breaking development, AMINA Bank has emerged as the first global bank to directly support Ripple’s RLUSD. Based in Switzerland, AMINA is a cryptocurrency bank dedicated to providing comprehensive crypto services to institutions and professional investors. According to their press release, AMINA will now offer custody and trading services for RLUSD. This partnership represents a significant melding of traditional banking security with the innovative efficiency of blockchain technology, marking AMINA as a pioneer among banks venturing into digital assets.

Institutional Interest in RLUSD Grows

The design of RLUSD is particularly appealing to businesses and financial institutions that necessitate reliable on-chain settlements. The strategic move by AMINA comes at a time when there is a heightened demand for regulated stablecoins, as more companies seek assets with stable prices and transparent mechanisms. As of June 2025, RLUSD’s market capitalization has surpassed $440 million, indicating a positive trend in institutional interest and usage. The recent minting of 16 million tokens is expected to enhance RLUSD’s liquidity, potentially encouraging a broader range of use cases in the financial ecosystem.

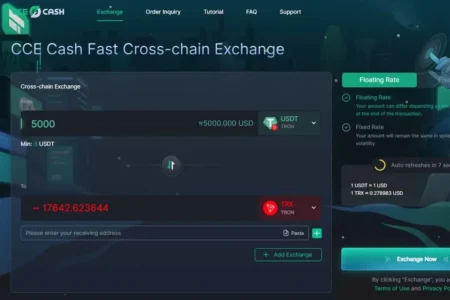

Strengthening International Payments

Ripple’s objectives extend beyond just increased liquidity; it aims to solidify its presence in international payments by collaborating with regulated banks to support RLUSD. By ensuring that RLUSD serves as a reliable intermediary between fiat currencies and cryptocurrencies, Ripple is positioning itself to compete effectively against dominant stablecoins like USDT and USDC. The partnership with AMINA is illustrative of a broader trend where banks are increasingly willing to embrace blockchain solutions as part of their operations.

Bridging Traditional Finance and Crypto

The combination of Ripple’s new mint and AMINA’s support is significant as it demonstrates the potential for synergy between traditional banks and blockchain networks. This collaboration serves as a catalyst for more institutions to adopt RLUSD, possibly shaping the future trajectory of digital finance. Prior to teaming up with AMINA, Ripple had also formed a partnership with OpenPayd to simplify the process of converting fiat currency into RLUSD, further establishing a robust framework for its growth in the competitive stablecoin market.

Future Prospects for RLUSD

As RLUSD continues to gain momentum, the implications for both traditional finance and the cryptocurrency space are profound. The support from AMINA Bank, along with Ripple’s initiatives, signifies a shift as more banks explore blockchain-backed solutions. This partnership may inspire other financial institutions to adopt similar strategies, potentially leading to an accelerated evolution in the financial landscape where digital assets coexist with traditional currency systems.

With the increasing institutional interest and regulatory focus on stablecoins, Ripple’s RLUSD is well-positioned for future growth and acceptance in global finance. As the crypto ecosystem continues to evolve, RLUSD might just pave the way for a new era in the realm of stablecoins, bridging the gap between traditional finance and the digital currency revolution.

In summary, Ripple’s ambitious approach to expanding the RLUSD supply, combined with AMINA’s support, is a significant step toward integrating digital currencies into the mainstream financial framework. As we look towards the future, the collaboration between cryptocurrencies and established financial institutions will likely play a crucial role in redefining the financial services landscape.