Ripple’s Legal Challenges: Insights on Linqto and Investor Impact

In recent months, Ripple has found itself at the center of a legal storm involving Linqto, the Securities and Exchange Commission (SEC), and the Department of Justice (DoJ). This situation comes on the heels of a Wall Street Journal report indicating that Linqto allegedly violated securities laws by facilitating the purchase of private shares in significant startup companies prior to their initial public offerings (IPOs). Ripple’s CEO, Brad Garlinghouse, has made it clear that while Linqto holds 4.7 million shares of Ripple, the company has no direct business relations with Linqto.

Clarification from Ripple’s Leadership

As the situation unfolded, Garlinghouse distanced Ripple from Linqto’s activities, emphasizing that the shares Linqto bought were acquired from the secondary market, and not directly from Ripple. This crucial distinction is significant, particularly in light of the allegations surrounding Linqto’s sale of private shares to non-accredited investors. Garlinghouse’s statement aimed to reassure Ripple’s stakeholders that the company’s integrity remains intact amid these legal concerns.

The Allegations Against Linqto

The report from the Wall Street Journal raised alarms over Linqto’s practices, stating that the platform previously allowed retail investors, including some from sanctioned jurisdictions, to purchase Ripple shares at inflated prices. Furthermore, it was revealed that many investors were misled regarding the actual nature of their ownership. Instead of owning direct shares, they only possessed ‘units’ or shares of a Special Purpose Vehicle (SPV) that held the actual shares. This revelation triggers a series of regulatory questions regarding the legality of their operations and the implications of such practices.

The Non-Accredited Investor Dilemma

A particularly concerning aspect highlighted in the report is that approximately 5,000 of the SPV Ripple shareholders are classified as non-accredited investors. Former lawmaker John Deaton called this scenario a “regulatory nightmare.” The SEC has stringent regulations regarding non-accredited investors, primarily aimed at protecting less wealthy investors from potential losses in high-risk investments. The involvement of so many non-accredited investors raises significant questions regarding regulatory compliance and investor protection in the cryptocurrency space.

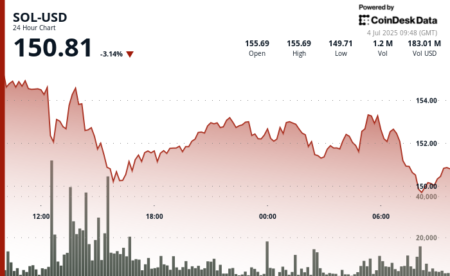

Financial Performance and Secondary Market Concerns

Garlinghouse pointed out that the 4.7 million Ripple shares held by Linqto have appreciated by a staggering 320% over the year, currently trading at $91. However, concerns have risen about Linqto being barred from trading Ripple shares in the secondary market due to evolving skepticism regarding their business practices. The future accessibility of these shares for the investors involved and the implications of being cut off from the secondary market could lead to uncertainty about the future profitability of their investments.

Broader Context and Investor Assurance

Other prominent firms, including Circle, Kraken, and SpaceX, have also utilized Linqto’s platform for their shares. Deaton has sought to reassure investors, affirming that the shares of various companies, including Ripple, are accounted for despite the legal entanglements. Notably, he mentioned that about 3% of Ripple’s shares were allegedly sold without investor consent, although the funds from that transaction remain secure. As fears grip investors, Deaton pointed out that those involved will have priority during any bankruptcy proceedings, thus highlighting the need for vigilance and informed decision-making in the current landscape.

Conclusion: The Road Ahead for Ripple and Investors

As the legal proceedings unfold, the future of Ripple’s relationship with Linqto and the implications for its investors remain uncertain. Stakeholders are left wondering whether the affected investors will ultimately be made whole or if further complications will arise. Ripple’s spokespersons have made efforts to clarify the company’s position, but the evolving regulatory landscape continues to challenge traditional investment avenues. For investors looking to navigate these turbulent waters, staying informed and understanding the implications of regulatory actions will be critical in protecting their interests in the emerging cryptocurrency market.

In conclusion, the situation underscores the importance of regulatory compliance and investor awareness, especially in a sector as dynamic as cryptocurrency. The interactions between companies like Ripple and platforms like Linqto will continue to be scrutinized as this legal battle progresses, shaping the future of investment in digital assets.