NEAR Token Rally Faces a Setback Amid Profit-Taking

In recent developments, NEAR token experienced a notable fluctuation as it briefly halted a rally that marked a 10% increase on Thursday. This surge was primarily triggered by Bitwise’s announcement regarding the launch of its NEAR exchange-traded product (ETP) in Germany, sparking interest among traders. Illia Polosukhin, co-founder of NEAR, mentioned to CoinDesk that "the NEAR Staking ETP on Xetra opens a new bridge to NEAR for institutions by providing a regulated, exchange-traded way to earn staking rewards." This innovation allows investors to access the NEAR ecosystem while ensuring compliance and price transparency, without the need for private key management or node operations.

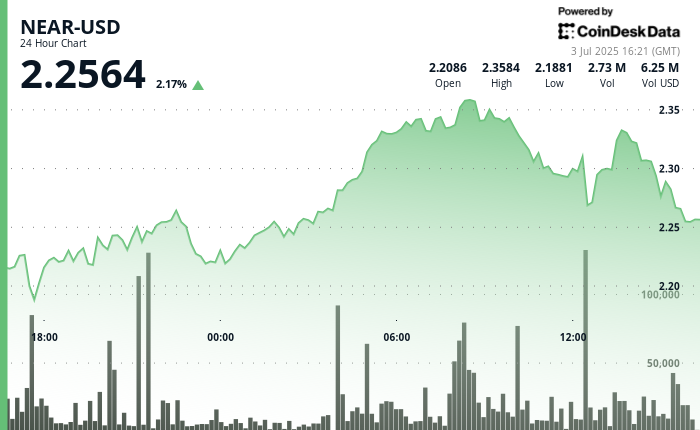

The NEAR token has effectively established a support level around $2.26, reflecting its potential to consolidate before attempting to ascend to further highs. As traders began to cash in their profits, the token’s price hovered around this threshold, with the observed activity indicating a strategic positioning among investors. The previous upward trend seems to have stabilized, paving the way for potential future gains as confidence in NEAR and its ecosystem continues to grow.

Technical Analysis Highlights Support Levels

From a technical perspective, NEAR has solidified its support level at $2.26, attributed to above-average trading volume between July 2nd and July 3rd. The early hours of July 3rd showed an impressive breakout, as NEAR breached the crucial $2.30 resistance level, achieving a new peak of $2.36, backed by significant volume confirmation. Traders closely monitored the 23.6% Fibonacci retracement level during the profit-taking phase, which provided notable support, affirming the prevailing bullish trend.

However, the market faced a brief sell-off, particularly noted during the 60-minute window between 14:50 and 15:49 on July 3rd. A significant spike in trading volume, exceeding 310,000 units, indicated heightened trading activity and volatility. As the session concluded, NEAR’s price stabilized at $2.26, suggesting sustained bearish pressure in the immediate term, while investors recalibrate strategies to navigate potential market fluctuations.

CoinDesk 20 Index Displays Mixed Signals

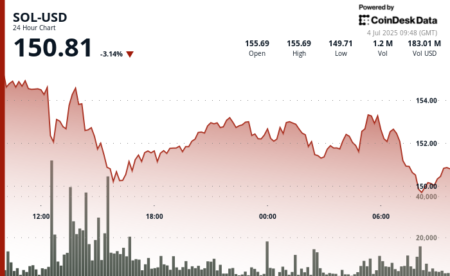

While NEAR’s performance exhibited volatility, the CoinDesk 20 Index (CD20) noted an overall upward trend, jumping by approximately 2% before a late-session sell-off took place. Analyzed over a 24-hour period, the CD20 reached a high of $1,811.11 earlier in the session, only to retract to $1,791.50 by close. Despite this variance, aggressive buying momentum during key hours indicated potential institutional accumulation, highlighting a noticeable interest in digital assets amid shifting market dynamics.

Additionally, the late session profit-taking signals that traders are actively managing their positions, further emphasizing the importance of market sentiment in influencing price movements. As NEAR token strives to maintain stability, these fluid market dynamics underscore the need for traders to execute strategies that account for both upward momentum and inherent risks associated with volatility.

Institutional Interest in NEAR ETP

The launch of the NEAR Staking ETP offers institutional investors a compliant avenue to earn staking rewards, which could catalyze increased traction within the NEAR ecosystem. With the rise of various blockchain technologies and the increasing acceptance of cryptocurrencies, institutional participation is likely to grow. Bitwise’s introduction of the NEAR ETP signifies a shift in investment strategies, aligning with greater institutional confidence in blockchain assets.

The implication of this development extends beyond immediate market transactions; it lays the foundation for further innovation and adoption within the digital asset space. Presenting a regulated framework for institutions marks a pivotal moment for NEAR, as it enhances the legitimacy and accessibility of its ecosystem to a broader audience of investors continuing to pave the path for decentralized technology.

Future Prospects for NEAR Token

As NEAR consolidates its present price, traders and analysts are closely observing key resistance and support levels. The psychological threshold at $2.30 remains crucial for sustainability, and breaking above this resistance could trigger renewed interest and further investment influx. Additionally, the creation of robust trading products like the NEAR ETP is likely to foster further institutional engagement — a crucial driver in the ongoing maturation of the NEAR ecosystem.

With innovators like Bitwise actively working to facilitate institutional investment opportunities, NEAR’s trajectory suggests significant potential for future price appreciation. However, navigating volatility and profit-taking trends will remain essential for traders looking to capitalize on market movements. The growing emphasis on security, transparency, and regulatory compliance within the NEAR ecosystem offers encouraging prospects for sustained growth amidst evolving market paradigms.

Conclusion: Strengthening NEAR’s Market Position

In summary, NEAR’s momentary rally and subsequent profit-taking illustrate the intricacies of cryptocurrency trading, characterized by fluctuating sentiments and market dynamics. As the NEAR Staking ETP provides robust pathways for institutional participation, the growing adoption of blockchain technologies signals a promising future trajectory for NEAR and other digital assets.

While immediate bearish pressures and fluctuations may pose challenges, the underlying fundamentals bolstered by institutional interest present substantial opportunities for growth. With thoughtful trading strategies and a focus on key market indicators, traders can effectively position themselves within the evolving landscape of digital assets, tapping into the transformative potential that NEAR offers to both retail and institutional investors alike.