Solana’s Momentum Amid Market Volatility: The Rising Institutional Interest

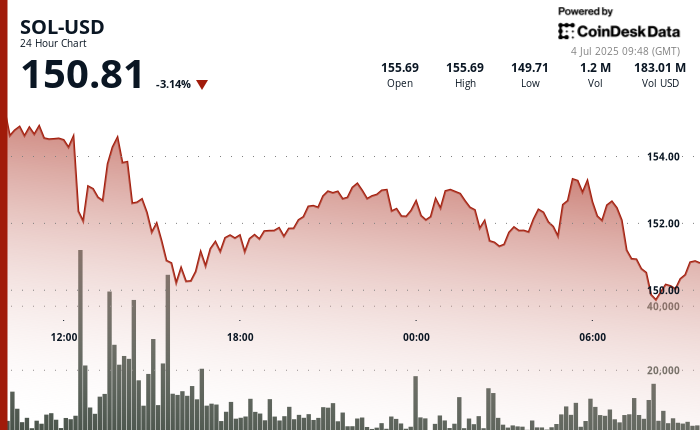

In the ever-evolving world of cryptocurrency, Solana has recently faced a downturn, with prices dipping by 3.36%, falling from $155.69 to $150.81. This price shift reflects broader market pressures, but there are bright spots indicating a growing institutional interest in Solana’s infrastructure, particularly in Asia.

Institutional Developments in Asia

A notable initiative comes from Minna Bank, a digital-native bank under the Fukuoka Financial Group in Japan. They have announced a strategic collaboration with Fireblocks, Solana, and TIS to explore how stablecoins and Web3 wallets can transform consumer finance in Japan. The emphasis of this collaboration is on aligning with the digital preferences of Japan’s mobile-first population, making it a pivotal player in attractive new financial services.

The Role of Stablecoins

The potential of stablecoins is significant. Currently, the stablecoin market surpasses $250 billion in market capitalization, capturing the interest of banks aiming to modernize payment systems and improve cross-border transaction efficiency. Fireblocks’ CEO, Michael Shaulov, emphasizes that the partnership might streamline how value is exchanged in the digital economy, presenting a robust case for integrating blockchain solutions into everyday financial operations.

Targeting Underserved Demographics

Minna Bank’s customer demographic is primarily between the ages of 15 and 39, which are often neglected by traditional banking systems. By integrating stablecoin solutions, the bank can cater specifically to the financial habits of this age group, potentially enhancing user experience and driving adoption. This strategic alignment might serve not only to improve customer satisfaction but also to strengthen the bank’s market position in a competitive environment.

Solana’s Innovation Potential

Despite Solana currently trading below its recent highs, developments like the Minna Bank initiative highlight the platform’s enduring appeal for enterprise and fintech innovation. The recent launch of REX-Osprey’s Solana + Staking ETF and the expansion of holdings by DeFi Development Corp demonstrate a robust institutional confidence in Solana that surpasses mere fluctuations in market prices.

Technical Analysis Insights

Over the past 24 hours, Solana’s trading showcased volatility, with a range between $155.79 and $149.13, indicating a 4.28% intraday fluctuation. The technical analysis indicates that while resistance formed at $153.77, support remained solid at $149.13, showcasing bullish buying interest as the price stabilized around $150.63. As Solana moves into a recovery phase, the mini-uptrend suggests potential for upward momentum, reflecting ongoing market interest.

Conclusion: Navigating the Future

While short-term volatility may pose challenges, the ongoing developments in Solana’s ecosystem, particularly those spearheaded by innovative partnerships, underscore its potential in reshaping future financial landscapes. As institutional interest continues to grow and new applications emerge, Solana is well-positioned to capitalize on the increasing demand for blockchain solutions in Asia and beyond. Stakeholders and investors must keep a cautious watch on these trends as they unfold in the coming months.