Traders Flood Bitcoin Ahead of Strong U.S. Jobs Data: Insights into Market Momentum and Altcoin Prospects

As traders anticipate broader trends in the cryptocurrency market, a surge in Bitcoin trading activity signals confidence, especially as the U.S. job data emerges. This article delves into the recent spike in Bitcoin investments, the implications of the U.S. labor market’s performance, and the potential for altcoins to rally in a shifting economic landscape.

Aggressive Bitcoin Buying on Binance

In the lead-up to the U.S. Nonfarm Payrolls report, Bitcoin’s Net Taker Volume on Binance surged past the $100 million mark. This spike indicates that traders were predominantly placing buy orders rather than waiting for price dips, demonstrating a pronounced risk-on sentiment. This bullish behavior appears to be tied to expectations surrounding macroeconomic indicators. Analysts noted a significant upswing in Bitcoin prices and highlighted the impact of traders chasing momentum, a phenomenon often referred to as FOMO (Fear of Missing Out).

This speculative approach suggests traders are keenly aware of market dynamics and are positioning themselves ahead of potential market-moving events. According to Matt Mena, a Crypto Research Strategist at 21Shares, positive sentiment was not just confined to Bitcoin; broader markets, including the S&P 500 Futures, showed signs of strength, trending close to all-time highs.

Impact of the U.S. Jobs Report

On July 3rd, the U.S. labor market reported stronger-than-expected performance, with Nonfarm Payrolls increasing by 147,000 and the unemployment rate falling to 4.1%. These figures surpassed consensus forecasts and indicate a robust economic landscape. The stronger labor market likely influences the Federal Reserve’s monetary policy decisions, suggesting that interest rates may remain elevated for a longer period.

This environment poses a double-edged sword for crypto traders; rising confidence can bolster investments in digital assets, while strong economic figures may lead to a stronger dollar. Following the data, traders adjusted their rate expectations, with Fed funds futures now indicating a 95% probability that the Fed will keep rates steady during its upcoming meeting.

Altcoin Momentum and Market Health

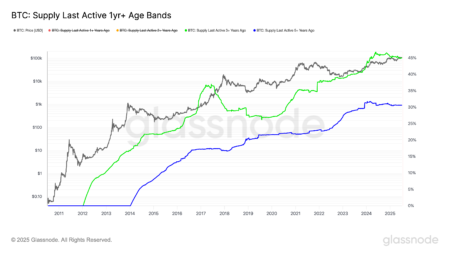

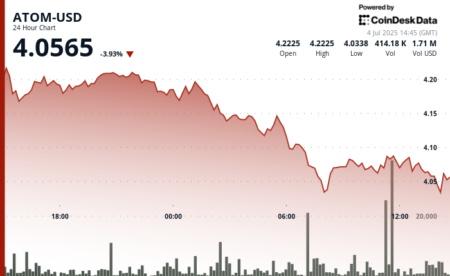

Despite looming concerns related to the Fed keeping rates high, the altcoin market is beginning to show signs of resilience. Mena noted a decline in Bitcoin dominance, which dropped 3% to 62%, pointing to increasing activity within the altcoin space. As traders diversify their portfolios, capital may flow into altcoins, potentially leading to significant price movements.

With improving investor sentiment and regulatory clarity on the horizon, conditions appear ripe for digital assets to thrive. Mena suggests that cryptocurrencies could see a substantial rally, with Bitcoin positioning itself for a potential breakout toward the $200,000 mark, and altcoins possibly reaping even greater rewards.

Navigating Macro Challenges

While traders have shown an aggressive inclination towards Bitcoin, the favorable labor market data introduces new complexities. A stronger labor market typically correlates with a stronger U.S. dollar, which tends to pose challenges for cryptocurrency prices. Historical trends indicate that robust employment figures combined with diminished rate cuts often exert downward pressure on Bitcoin and other cryptocurrencies.

Consequently, while bullish sentiment persists, traders should remain cautious of the macro backdrop that could hinder price advancements. Mena emphasized that while factors like stable labor markets, cooling inflation, and increased liquidity may lay a foundation for growth, macroeconomic indicators can shift the landscape rapidly.

Future Prospects for Cryptocurrency

In summary, the surge in Bitcoin investments signals a broader market optimism despite the uncertain macroeconomic conditions. The resilient U.S. labor market presents a complex scenario for crypto investors, intertwining opportunities with potential challenges. As Bitcoin and altcoins strive for recovery, the interplay between traditional financial dynamics and digital assets becomes increasingly crucial.

Investors may find that diversifying into altcoins could be a strategic move as traders adjust their portfolios and seek growth outside of Bitcoin. With favorable economic conditions possibly on the horizon, a sustained commitment to monitoring market trends and macroeconomic indicators can help traders navigate the rapidly evolving cryptocurrency landscape.

Conclusion

In conclusion, the current momentum surrounding Bitcoin and altcoins highlights a critical moment for traders. While the recent spike in Bitcoin trading volume demonstrates strong confidence ahead of the U.S. jobs data, the subsequent economic indicators present challenges that investors must navigate. Balancing bullish sentiment with macroeconomic realities will be essential as the cryptocurrency market continues to evolve. As new opportunities emerge, particularly in altcoins, staying informed and strategically diversified could pave the way for successful trades in the future.