XRP Price Analysis: Potential 50% Surge Ahead

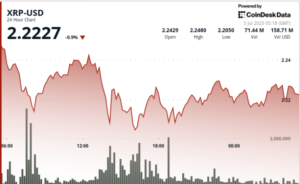

As of July 4, XRP is trading at $2.2378, reflecting a slight decrease of less than 1% from the previous day. Despite this minor fluctuation, the market holds several promising indicators suggesting a potential surge of up to 50%. Factors such as the formation of a symmetrical triangle pattern, the rising market cap of RLUSD, and the increasing interest in the Teucrium Leveraged XRP ETF paint a positive outlook for investors in the coming weeks.

Technical Indicators Point to a Possible Breakout

The ongoing consolidation of XRP’s price can be likened to the calm before a storm, hinting at a forthcoming surge. Over the past few months, XRP has established a symmetrical triangle pattern characterized by converging lines. Such a formation often precedes significant price movements, either upward or downward. Historically, the breakout tends to follow the original trend that led to the triangle formation. Given that this triangle emerged after a colossal 500% price hike in November, a bullish breakout appears to be on the horizon. If XRP manages to break upwards, a target close to the year-to-date high of $3.50 may be achievable, indicating a potential 50% increase from current levels.

The Role of XXRP ETF in Price Fluctuation

A crucial factor that could facilitate a rebound in XRP’s price is the growing appeal of the Teucrium 2X Long Daily XRP ETF (XXRP). Since its launch in April, this ETF has experienced consistent inflows and is approaching the $160 million mark in assets. Investors have shown interest despite its high expense ratio of 1.89%, one of the most elevated rates on Wall Street, especially when compared to the average expense ratio of under 0.25% for mainstream ETFs. Notably, while the XXRP ETF has grown by about 15% since its inception, XRP itself has risen by 24% during the same period. This disparity suggests a promising future for spot XRP ETFs, which are anticipated to be approved later this year, potentially attracting significant investments.

Market Cap Growth Highlights Demand

In tandem with the XXRP ETF’s expansion, the RLUSD market cap is also on the rise, nearing $500 million. Such growth is critical as it reflects heightened investor confidence in the cryptocurrency space. The increasing market cap could serve as a catalyst for further investment in XRP. Furthermore, with companies increasingly integrating XRP into their operations, market sentiment may boost XRP’s price trajectory. The convergence of these elements—the ETF’s popularity, rising market cap, and corporate integration—could well set the stage for a significant upward movement in XRP’s price.

Key Price Levels and Risks to Watch

While the outlook for XRP leans bullish, it’s vital to acknowledge the risk factors involved. If XRP fails to maintain support at key levels, particularly below $1.6147, this could invalidate the current positive price forecast. A downturn below this critical threshold raises the alarm for a potential drop to below $1. Conversely, sustaining momentum above $2.50 could signal an impending breakout, reinforcing the bullish sentiment in the market. Therefore, vigilant monitoring of XRP’s price action around these levels is crucial for investors.

Future Prospects Amidst Market Trends

The primary catalysts driving XRP’s potential price surge include the impressive XXRP ETF inflows and the overall market cap growth. As the mainstream acceptance of cryptocurrencies continues, XRP is well-positioned to capitalize on this trend. Predictions from analysts suggest that the anticipated approval of spot XRP ETFs could draw up to $8 billion in inflows within the first year, further supporting a bullish trend. Such developments could bolster XRP’s price significantly, especially as it targets the psychological barrier of $5.

Conclusion: Is a Bullish Breakout Imminent?

In summary, XRP’s formation of a symmetrical triangle pattern along with burgeoning ETF interest and market cap growth suggests a significant bullish potential in the near future. With a target price around $3.50, representing a promising 50% increase, investors should remain astutely aware of market dynamics and key price levels. While the outlook remains positive, careful consideration of risks and close monitoring of price movements will be essential for anyone looking to invest in XRP. As always, prospective investors are encouraged to conduct their own research before diving into the cryptocurrency market, given its volatility and inherent risks.

If you have further questions about XRP or the broader cryptocurrency market, or if you’re considering investments, you should seek advice from financial experts and stay informed about market trends.