PLUME’s Strategic Partnership Sparks Optimism: A Market Analysis

The recent announcement of Plume’s partnership with World Liberty Financial (WLFI) has ignited a wave of optimism in the market for the EVM-compatible blockchain token, PLUME. This collaboration aims to enhance the adoption of WLFI’s USD1 stablecoin by integrating it as a reserve asset for Plume’s on-chain stablecoin, pUSD. The implications of this partnership are far-reaching, as it opens new channels for investors wishing to engage with institutional-grade real-world asset (RWA) finance opportunities.

An Overview of the Partnership

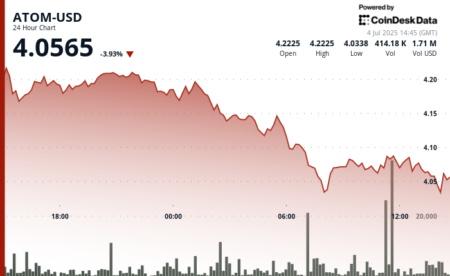

On July 1, Plume revealed its strategic alliance with World Liberty Financial, a company connected to former U.S. President Donald Trump. With the USD1 stablecoin poised to be integrated into the Plume ecosystem, market participants are presented with fresh opportunities for financial engagement. This exciting development has already proven beneficial; PLUME’s value surged by 17% the following day, signaling strong investor interest. With a modest market capitalization of $209 million, even small inflows could lead to significant price fluctuations, prompting traders to tread carefully in their market strategies.

Market Structure and Technical Analysis

From a technical standpoint, the recent market structure has shown promising signs for PLUME. Following the announcement, Plume successfully broke its previous market structure, a move denoted on technical charts. Nevertheless, it is crucial to note that the token has been on a declining trend since May. Historical data has demonstrated a bearish swing structure, necessitating a careful examination of resistance zones as the price attempts to recover. Notably, the Fibonacci retracement levels indicate potential resistance around $0.158 and $0.181, which investors should monitor closely.

Resistance and Support Levels

The market witnessed the token challenge a bearish order block at the $0.123 level on July 2, which acted as a resistance point. This experience has heightened the interest among traders as they seek to discern the next potential price movements. Despite these challenges, positive signs are emerging from the On-Balance Volume (OBV) that recently surpassed its June highs, indicating increased demand. The accompanying trading volume metrics further corroborate this upward trend, suggesting that a shift in market sentiment is occurring.

Momentum Indicators Favor Recovery

As of now, the Relative Strength Index (RSI) has positioned itself above the neutral 50 mark, a further indication of bullish momentum. This alignment of multiple technical indicators suggests that positive price action may persist in the upcoming weeks. For investors looking to capitalize on this bullish run, maintaining investments above the psychological support level of $0.1 could prove advantageous. Traders should consider this benchmark as a critical point for potential buying strategies.

Key Takeaways

In summary, Plume’s strategic partnership with World Liberty Financial is not only generating excitement within the crypto community but also presenting new investment opportunities. Market trends indicate a potential for further gains, relying on both technical indicators and the bullish sentiment surrounding the token. However, traders should navigate the market with caution, staying vigilant about resistance levels and broader market dynamics. As PLUME continues to establish itself within the cryptocurrency ecosystem, its trajectory will remain a focal point for investors and market analysts alike.

Disclaimer

This article is for informational purposes only and does not serve as financial, investment, or trading advice. Always conduct your own research and consult with a financial advisor before making investment decisions.