The Dynamics of Long-Term Bitcoin Holders: Insights from Glassnode and CoinDesk Data

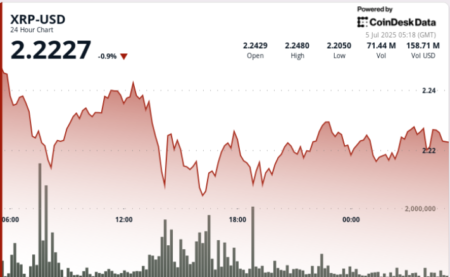

Bitcoin’s market behavior is a topic of ever-increasing significance among investors and enthusiasts alike. Defined as investors who have held their Bitcoin for at least 155 days, long-term holders (LTHs) play a crucial role in the cryptocurrency market, according to Glassnode. Recent insights from CoinDesk Research highlight a noteworthy trend: the selling pressure from these LTHs is one of the key factors preventing Bitcoin from reaching new all-time highs.

Long-Term Holders and Their Influence

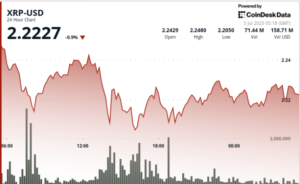

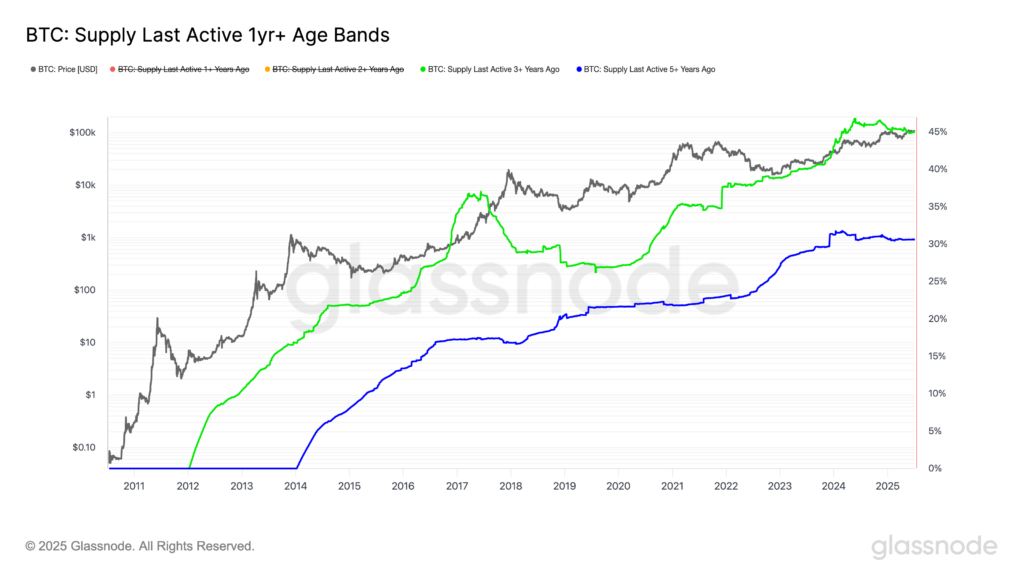

Understanding the motivations and behaviors of long-term holders can offer valuable insights into Bitcoin’s market dynamics. As of now, 45% of Bitcoin’s circulating supply has not moved for three years, mirroring figures seen in February 2024, shortly after the launch of the U.S. exchange-traded fund (ETF). This stability raises questions: why are long-term holders choosing to hold onto their assets during periods of market fluctuation?

The Bitcoin market is reminiscent of July 2022, during the leverage-driven crisis fueled by the collapse of companies like Three Arrows Capital and Celsius. Back then, Bitcoin was trading around $20,000. The same LTH cohort’s persistence during turbulent times signals a certain conviction that suggests many are waiting for a more favorable price point before making significant moves.

Market Pressures and the LTH Cohort

Despite LTH selling activity when prices rise, the broader behavior of this group has remained remarkably static over the past year. Only 30% of Bitcoin’s circulating supply has not changed hands in five years, indicating that a sizable portion of long-term holders are waiting rather than engaging in active trading. This behavior aligns with historical trading patterns where LTHs tended to sell their holdings at price surges, suggesting a well-calibrated strategy aiming for optimal returns.

Market analysts have observed the emotional gradient associated with trading behavior. Investors often succumb to fear and enthusiasm, influencing buying and selling decisions. Given the data, it appears that many LTHs possess a calm conviction, dismissing short-term volatility and remaining loyal to their investments.

The Role of Whales in the Market

Adding another layer to this analysis are Bitcoin whales, who are notoriously influential players in the market. Recently, reports indicate that some of these whales have begun to re-enter the market after extended periods of dormancy. Such movements raise additional questions about the overall market direction. When significant amounts of Bitcoin are moved, it can lead to increased volatility, as these transactions often trigger rapid price shifts.

Glassnode also points out that while long-term holders maintain their static status, whale activity could introduce complications. If whales liquidate their holdings suddenly, they could exacerbate selling pressure, affecting the LTH sentiment and potentially discouraging new investments.

A Broader Look at Bitcoin’s Market Sentiment

Market sentiment surrounding Bitcoin often swings with the broader economic climate. Events such as regulatory changes, institutional adoption, and macroeconomic indicators can all have a trickle-down effect on investment strategies. While LTHs are largely unfazed by daily market fluctuations, newer investors might be more vulnerable to such signals.

This distinction highlights the importance of fostering a long-term investment mindset among new entrants to the market. Instead of viewing Bitcoin solely as a speculative asset, it can be prudent to recognize the potential for value preservation and growth over extended periods.

Future Directions for Long-Term Holders

As we look at the data, it’s evident that the majority of Bitcoin’s circulating supply is in the hands of long-term holders. Their strategies will likely continue to shape the market in the coming years, especially as new economic conditions rise. Current trends suggest that many of these holders are waiting—either for the return of high prices or for other compelling market signals indicating it’s time to sell.

Despite the stagnant percentage of Bitcoin supply in the hands of long-term holders, the dynamics of ownership are fluid and ever-changing. The emergence of new market data will be key to understanding how these dynamics unfold over time.

Conclusion

In summary, the growing data from Glassnode and CoinDesk sheds light on the notable behaviors of long-term Bitcoin holders, their resistance to selling during market pressure, and the possible influences of market whales. As the landscape of Bitcoin continues to evolve, staying attuned to the activities and sentiments of this cohort will be crucial for anyone looking to navigate the often tumultuous waters of cryptocurrency investment. The faith exhibited by LTHs in their investments may ultimately shape not only their own financial futures but the larger trajectory of Bitcoin itself.