Market Sentiment and Bitcoin’s Performance: An SEO-Optimized Analysis

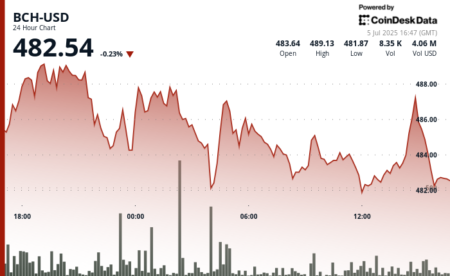

In recent weeks, the cryptocurrency market has witnessed a notable bullish trend, significantly affecting Bitcoin (BTC) and the broader altcoin ecosystem. As of late June, Bitcoin surged by 6.31%, while altcoins collectively gained 7.6%. This upward momentum indicates a strong investor sentiment, even amidst volatility and market fluctuations. Despite a slight downturn on July 4th triggered by profit-taking among short-term holders, the sentiment remains bullish. The ongoing fluctuations exemplify both the resilience and uncertainty prevalent within the market.

Understanding Recent Market Dynamics

Recent developments suggest the crypto market has been on a rollercoaster ride, particularly from late June through the beginning of July. The initial phase saw losses across both Bitcoin and altcoins, but this was quickly reversed soon thereafter. On July 2nd and 3rd, the market managed to extend its rally, demonstrating a robust recovery. However, by July 4th, renewed selling pressure emerged, highlighting the conflicting dynamics at play in the market. This volatility is largely attributed to looming economic factors, such as unresolved trade agreements from the Trump era, which are stirring additional uncertainty among investors.

Trade Agreements and Market Sentiment

While the U.S. has successfully reached trade agreements with countries like China and Vietnam, issues with key partners such as Japan, South Korea, and the European Union remain a significant concern. The specter of a potential trade war may be exacerbating selling pressure in the crypto market. Nevertheless, despite these uncertainties, investors show strong appetite for Bitcoin and Ethereum (ETH) ETFs, with a notable inflow of $601 million reported on July 3rd. This was the most substantial influx since May 22nd and reflects ongoing investor confidence in cryptocurrencies.

Crypto Fear and Greed Index Insights

At the time of reporting, the Crypto Fear and Greed Index indicated a robust reading of 73, signaling a state of greed in the market. With Bitcoin hovering just 3.9% below its all-time high, it is apparent that many holders are currently seeing profits. This has likely contributed to the short-term selling pressure observed on July 4th. It’s important to note that a reading of greed does not inherently predict an imminent price decline; historical data shows that similar sentiment can accompany significant price increases. For instance, the index reached 78 on May 23rd, coinciding with a peak Bitcoin price of $111.8K.

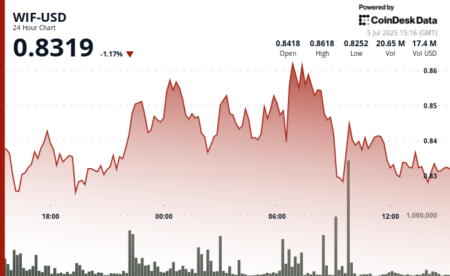

The Altcoin Landscape: Potential Weakness

As Bitcoin continues to exhibit strength, many altcoins appear to be lagging behind. This underperformance may hint at underlying weaknesses in the broader altcoin market, suggesting a caution signal for altcoin investors. Should Bitcoin endure further losses, volatility may become heightened, affecting altcoins disproportionately. Consequently, those invested in altcoins should prepare for market turbulence, adjusting their strategies accordingly to address potential risks.

Future Outlook for Bitcoin and Long-Term Holders

While predicting the precise timing for Bitcoin’s next all-time high remains uncertain, ongoing on-chain data analysis implies that a further upward move may be imminent. Long-term holders, or "HODLers," are likely to benefit from remaining patient during this volatile period. By exercising a disciplined approach and disregarding short-term market fluctuations, investors may position themselves favorably for future gains as the market evolves.

In summary, while recent bullish trends in the cryptocurrency market provide an optimistic outlook for Bitcoin, investors must remain vigilant of market dynamics, economic uncertainties, and potential volatility. As always, sound investment strategies, patient holding, and informed decision-making are crucial for navigating this complex landscape.