Dogecoin Sees Significant Rally Amid Political Developments

In a recent turn of events, Dogecoin (DOGE) experienced a notable rally of over 5% in just 24 hours, climbing from $0.163 to $0.171. This remarkable surge comes in the wake of Elon Musk’s unexpected announcement regarding the launch of the America Party, which has generated optimism for a more crypto-friendly political environment. The rally was propelled by a robust trading volume exceeding $1.1 billion, establishing a strong support level at around $0.166. Interestingly, while larger “whale” wallets have aggressively accumulated DOGE during this positive price movement, many smaller investors have opted to exit, hinting at renewed institutional confidence in the cryptocurrency.

The Impact of Elon Musk’s America Party Launch

Elon Musk’s surprise announcement over the weekend has sparked discussions on both political and crypto fronts. The America Party aims to advocate strongly for Bitcoin, taking a direct jab at former President Donald Trump’s "anti-innovation" financial policies. Although Musk did not explicitly mention Dogecoin during his announcement, his past contributions to integrating DOGE into various products, including Tesla and X (previously Twitter), have led to speculation on the token’s potential role within this political framework. Such conjectures speculate that Dogecoin may serve either as a cultural asset or a transactional medium in Musk’s envisioned future.

Market Dynamics and Economic Considerations

As this political landscape unfolds, broader economic uncertainties continue to loom. The looming tariff deadline set by President Trump on July 9 has created a ripple effect of volatility across the crypto and equity markets. Despite these challenges, Dogecoin has attracted heavy buying interest from significant wallet holders. Particularly, data from IntoTheBlock indicates that stocks held by whales ranging from 1 million to 100 million DOGE have increased, contrasting with a decline in retail positions. This dynamic underscores a shift in market sentiment, with institutional investors showing renewed interest in Dogecoin amidst the prevailing uncertainty.

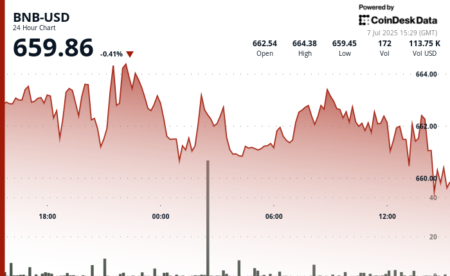

Technical Highlights of the Recent Rally

Delving into the technical aspects of Dogecoin’s recent performance, the cryptocurrency surged by 5.01% within 24 hours from July 6, 03:00 to July 7, 02:00. This upward trend was particularly pronounced between 12:00 and 13:00 on July 6, when the price jumped from $0.166 to $0.173 on significant volume. The rally also established a crucial support level at $0.166, with subsequent price action consolidating within the range of $0.170 to $0.173. Notably, a key resistance level was detected at $0.173 during a late-session sell-off that occurred between 21:00 and 23:00.

Increased Activity Among Whale Investors

Interestingly, the final hour of trading saw a minor gain of 0.85% as DOGE broke above $0.171, leading to notable trading spikes at 01:16 with 12.8 million DOGE traded and again at 01:36 with 8.0 million DOGE. This increased activity among whale investors suggests a strategic accumulation of DOGE, indicating their confidence in its future potential. In contrast, many retail investors have chosen to exit the market, possibly due to the inherent volatility and unpredictability associated with cryptocurrencies.

Future Outlook for Dogecoin

The intertwined relationship between political developments and market dynamics could heavily influence the future trajectory of Dogecoin. As discussions surrounding the America Party continue, the possibility of crypto being prioritized in political agendas could bolster DOGE’s legitimacy and acceptance. Moreover, if institutional investors maintain their bullish stance, it may lead to more stability and growth in Dogecoin’s price trajectory. As the crypto market remains susceptible to various external factors, including economic policies and investor sentiment, keeping an eye on these developments will be crucial for both investors and market analysts.

In summary, the recent rally of Dogecoin has drawn attention not just for its price movement, but for the larger narratives it intertwines with, particularly political shifts inspired by influential figures like Elon Musk. As new developments unfold, market participants will need to remain vigilant and adaptable in this ever-changing landscape.