The Rollercoaster of Crypto Trading: A Cautionary Tale of Over-Leveraging

In the ever-volatile world of cryptocurrency trading, the story of a Hyperliquid trader known as @qwatio serves as a cautionary tale about the risks of over-leveraging. Over the recent weekend, this ultra-leveraged trader suffered a staggering liquidation five times, losing nearly $3.7 million in the span of just one week. His trading strategy chiefly involved aggressive short positions on Bitcoin (BTC) and Ethereum (ETH), which contributed to his dramatic financial collapse.

Understanding Hyperliquid Trading and Its Risks

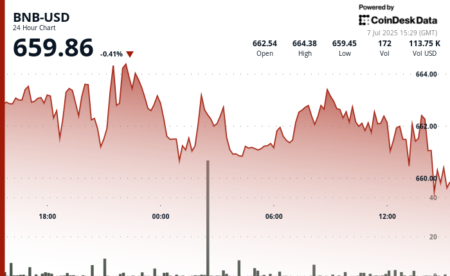

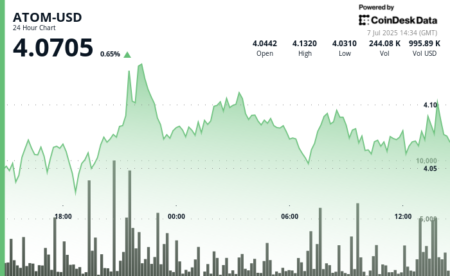

Hyperliquid trading refers to the practice of executing high-frequency trades with significantly leveraged assets. While some traders opt for careful strategies, @qwatio chose to implement aggressive shorts on BTC, currently priced around $108,808.62, and ETH at $2,565.27. Unfortunately, this risky approach led to numerous liquidations—387 BTC and 2,990 ETH were wiped out from his portfolio, which dwindled from $16.28 million to a mere $610,000. Such staggering losses underscore the vital importance of managing leverage effectively in cryptocurrency trading.

The Shift from Longs to Shorts

Initial trading patterns for @qwatio involved bullish longs earlier in the year, betting on rising prices. However, this shift to shorting at what he believed were market lows could have been influenced by recent price movements. When traders switch strategies amid fluctuating market conditions, it can result in significant losses if not carefully managed. In this case, @qwatio’s decision to short during perceived market lows seemed to backfire catastrophically, echoing the old adage “buy low, sell high” but taken to the extreme.

A Broader Market Context

Within just 24 hours surrounding this incident, the broader market experienced similar turmoil, with approximately $50 million of ETH and $31 million in BTC liquidated. This pattern echoes a trend wherein increasing numbers of traders leverage their bets, often leading to simultaneous liquidations when market conditions turn unfavorable. Data from CoinGlass indicates this chaotic landscape isn’t just an isolated incident but part of a larger issue affecting traders globally, exacerbated by emotional decision-making driven by fear and greed.

Lessons in Risk Management

The dramatic downfall of @qwatio highlights the importance of robust risk management strategies in cryptocurrency trading. Educating oneself about the risks associated with leveraged trading can significantly impact long-term profitability. Traders should thoroughly assess their risk tolerance, establish stop-loss orders, and avoid the temptation to over-leverage. In addition, employing a diversified investment strategy can help cushion potential losses and ensure greater resilience against market fluctuations.

Conclusion: Navigating the Crypto Landscape Wisely

The turbulence of the cryptocurrency market is a double-edged sword, providing opportunities for high rewards but also substantial risks. As evidenced by @qwatio’s story, those involved in crypto trading must tread cautiously, especially when dealing with leveraged positions. It’s a reminder that while the allure of large gains can be tempting, the consequences of poor decision-making can be devastating. By promoting sound trading practices and enhancing risk management skills, traders can navigate the turbulent crypto landscape with greater confidence and stability.