Solana’s Market Movement and Network Growth: A Comprehensive Overview

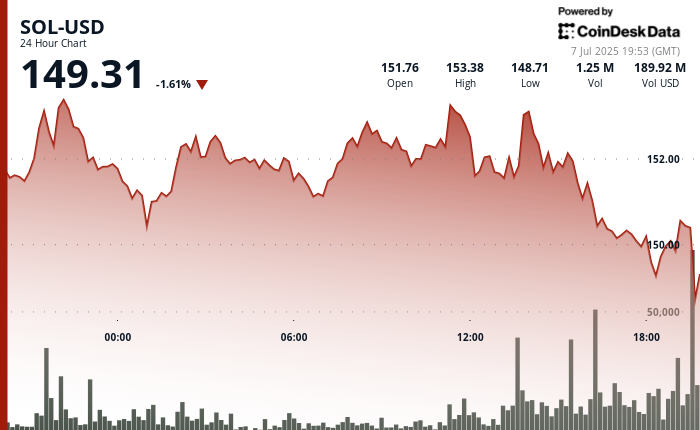

In the ever-evolving cryptocurrency landscape, Solana remains a standout with its recent market activities and increasing user engagement. Over the past 24 hours, Solana’s price saw a decline of 1.45%, transitioning from $151.41 to $149.21 between July 6 and July 7, 2025. This decrease reflects broader trends in the crypto market, particularly highlighted by a 0.56% drop in the CoinDesk 20 Index (CD20). Such fluctuations are not uncommon, given the current market volatility, affecting investors’ sentiment across the board.

During this trading period, Solana exhibited considerable price variation, reaching a maximum price of $153.67 before a notable sell-off pushed it below the critical $150 mark—a significant psychological threshold for traders. Increased trading volume near the session’s low indicates sustained buyer interest in the $149 support zone, prompting a slight rebound to $149.31 by the close of the observation window. This resilience showcases the market’s dynamic nature, where buyers are keen to capitalize on favorable price points amid prevailing uncertainty.

Despite these short-term price challenges, Solana’s underlying on-chain metrics convey a more robust narrative. Notably, data from analytics platform Artemis reveals that in June 2025, Solana reported monthly active addresses comparable to the combined figures of all other Layer 1 and Layer 2 blockchains. This surge in user activity coincided with record-breaking network revenue, as reported by Blockworks. Specifically, Solana generated over $271 million in revenue during Q2 2025, marking its third consecutive quarter as the leader in network revenue derived from transaction fees and external tips. Such impressive financial figures underscore Solana’s growing prominence in the blockchain ecosystem.

Importantly, the consistent increase in network revenue not only reflects economic activity but also highlights the sustainability of Solana’s fee model. As developers and users continue to adopt Solana’s high-speed infrastructure, the existing patterns of network usage are likely to foster long-term value. This trend positions Solana favorably, even as it navigates immediate price pressures amidst the volatile market landscape.

Technical Insights into Solana’s Price Movements

In resolute detail, Solana’s technical analysis over the 24-hour period captures its price dynamics crisply. Starting from $151.41, the price fluctuated within a narrow range of $4.58, peaking at $153.67 before experiencing a downward trend. This period was marked by a considerable volume spike of approximately 925,497 tokens, creating a resistance level at $153.67. As highlighted, when the price decisively broke below the $150 mark with increased trading volume, bearish sentiment became apparent, dampening short-term outlook prospects.

As the day progressed, Solana experienced additional movement, culminating in a decline from $150.27 to $149.72 between 17:41 and 18:40 UTC. A sharp sell-off momentarily drove prices to a low of $149.42, contributing to the increased trading volume exceeding 57,000 tokens. However, the subsequent defense of the $149 support zone illustrated a coordinated effort by buyers, leading to a modest rebound of 0.37% from the session’s lowest prices.

Solana’s Position in the Blockchain Ecosystem

The remarkable growth and sustained activity on the Solana network elucidate its significance within the broader blockchain domain. As the cryptocurrency industry continues to mature, Solana distinguishes itself as a preferred choice for developers and users seeking scalable solutions. Its architecture allows for high-speed transactions and low fees, facilitating seamless interactions that appeal to a growing audience.

Moreover, Solana’s suite of decentralized applications (DApps) and services enhances its utility, drawing more users into its ecosystem. This growing developer engagement suggests a promising future trajectory for Solana, fostering innovation and adoption at unprecedented rates. As this activity intensifies, Solana is likely to further broaden its user base, fortifying its standing as a robust blockchain platform.

Conclusion

In summary, despite recent price declines, Solana showcases remarkable resilience underpinned by significant user growth and network revenue. The fluctuations observed in its market price reflect a volatile landscape that is characteristic of cryptocurrency investments. However, the positive trends in user engagement and economic activity signal a robust and growing ecosystem. Whether Solana can sustain this upward momentum in the face of ongoing price challenges remains to be seen, but its current trajectory suggests a promising future within the blockchain industry.

By understanding the intricate interplay of market dynamics and network activity, investors can gain valuable insights into Solana’s potential as a key player in the cryptocurrency space. As the blockchain environment evolves, Solana’s strong fundamentals may provide a solid foundation for long-term success amid the transient nature of price movements.