World Liberty Financial (WLFI): Accelerating Global Crypto Strategy

World Liberty Financial (WLFI) is making significant strides in its international strategy, building alliances and launching innovative products designed to enhance mainstream adoption of its platform. The company is linked to former U.S. President Donald Trump and is actively working to secure a stronger foothold in the rapidly growing global cryptocurrency ecosystem. Recently, WLFI’s partnerships and upcoming initiatives signal a pivotal moment for the firm as it seeks to expand its reach beyond U.S. borders.

Strategic Partnership with Bithumb

On September 23, WLFI announced a partnership with South Korea’s prominent crypto exchange, Bithumb, through a Memorandum of Understanding (MoU). This agreement is poised to unlock new opportunities in decentralized finance, allowing both companies to gain broader market access and fortify investor confidence. Bithumb’s CEO, Lee Jae-won, has characterized the collaboration as a significant milestone in enhancing the exchange’s global competitiveness. The alignment with Bithumb follows WLFI’s earlier MoU with the Pakistan Crypto Council, reflecting a deliberate strategy to penetrate the Asian market and seize opportunities in one of the world’s fastest-growing crypto regions.

WLFI’s Innovative Consumer Offerings

In tandem with expanding its partnerships, WLFI is preparing to launch consumer-friendly products that aim to bolster platform adoption significantly. During the Impact Conference in Seoul on September 22, WLFI’s co-founder Zak Folkman announced plans for an innovative debit card integrated with Apple Pay. This financial product will facilitate seamless transactions using WLFI’s USD1 stablecoin, allowing users to engage in everyday purchases effortlessly. By increasing the token’s utility, WLFI hopes to enhance its market capitalization from its current standing of $2.69 billion, positioning itself as a competitive player in the cryptocurrency landscape.

Upcoming Retail Payments App

Beyond the debit card, Folkman revealed additional plans for a retail payments application that combines elements of popular financial platforms like Venmo and Robinhood. This app is designed to simplify crypto payments for average users, effectively reducing barriers to participation in the emerging digital asset economy. By crafting solutions that cater to everyday consumers, WLFI aspires to attract a broader audience, fostering greater usability and adoption of cryptocurrencies.

Recent Market Trends and Challenges

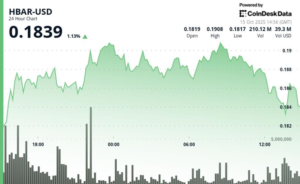

Despite WLFI’s ambitious initiatives, the cryptocurrency asset has faced challenges in recent weeks, leading to price declines. According to CryptoSlate data, WLFI’s price dipped roughly 4% in a single day, reaching $0.2058, which contributes to a month-long decline of about 10%. This downturn mirrors the sentiments affecting larger cryptocurrencies such as Bitcoin and Ethereum, which have also experienced significant market fluctuations, culminating in a major $1.7 billion market liquidation event on September 22.

Emerging Opportunities in Asia

As WLFI pursues its strategies, the partnerships with Bithumb and the Pakistan Crypto Council indicate an intent to tap into regions where the cryptocurrency market is expanding rapidly. The focus on strategic alliances enhances WLFI’s credibility, improving its potential reach and attracting international investors. The burgeoning crypto ecosystem in Asia presents fertile ground for WLFI’s growth, and the company appears well-positioned to capitalize on these emerging opportunities.

Conclusion: A Bright Future for WLFI

In summary, World Liberty Financial is taking decisive steps towards international expansion through strategic partnerships and innovative products. The collaborations with Bithumb and other entities are not only designed to bolster WLFI’s competitive edge but also aim to drive mainstream adoption of its platform. While the market has presented challenges, the company’s focus on consumer-friendly solutions could ultimately pave the way for a robust future in the evolving landscape of cryptocurrencies. As WLFI charts its path forward, it will be interesting to observe how these initiatives translate into tangible results in the global market.