Major Bitcoin Liquidation Event: Insights and Implications

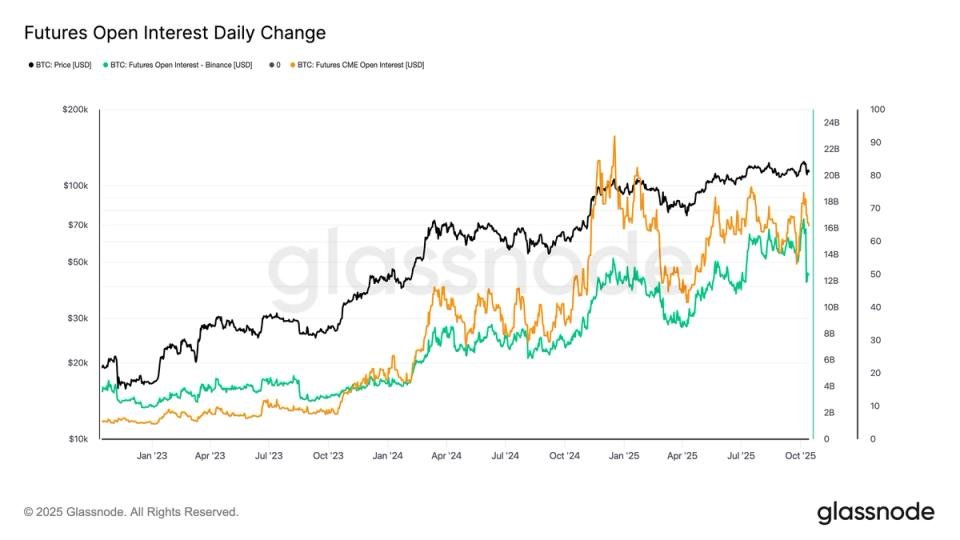

Friday witnessed a seismic liquidation event in the cryptocurrency arena, marking the largest deleveraging episode in Bitcoin’s history. Understanding this colossal loss requires examining open interest (OI), which is the total value of outstanding futures and perpetual contracts that remain unsettled. Analysts at Glassnode captured a historical moment where Bitcoin’s OI soared to around $70 billion prior to Friday, an unprecedented all-time high representing approximately 560,000 BTC in futures positions. However, post-sell-off, this figure plummeted to about $58 billion, equating to roughly 481,000 BTC.

The dramatic decline in OI can be viewed more precisely in BTC terms, as the value in USD fluctuates with Bitcoin’s price. On the day of the sell-off, Bitcoin’s price slid from $122,000 to $107,000, affecting OI figures in USD. This sell-off resulted in a staggering $10 billion loss in OI within a single day. Notably, this marks the most significant single-day decline in Bitcoin’s OI in USD terms, and ranks as the second-largest decline in BTC terms, following the infamous COVID-crash of March 2020 when Bitcoin’s price hovered around $5,000.

When broken down by exchange, the data reveals that the deleveraging was most pronounced in crypto-native trading platforms rather than traditional finance. The Chicago Mercantile Exchange (CME), known for catering to institutional investors, showed minimal changes, holding steady at around 145,000 BTC. In stark contrast, Binance, the second-largest futures exchange, recorded substantial reductions in OI, dropping from $16 billion (130,000 BTC) to $12 billion (105,000 BTC). This suggests a concentrated deleveraging largely within crypto-centric platforms.

Historically, major declines like this in open interest often coincide with market bottoms. Notable precedents include the COVID crash in 2020, the mid-2021 downturn amid China’s mining restrictions, and the subsequent FTX collapse in late 2022. The pattern suggests that after such significant drop-offs in OI, markets often find a base level from which recovery can occur.

The implications of this Friday’s event are severe for the market, calling into question liquidity conditions and price stability within cryptocurrency ecosystems. As participants unwind their leveraged positions, volatility may ramp up, leading the market to experience increasingly erratic price fluctuations. Investors and analysts alike will now be looking to identify trends and revenue patterns that can follow this unprecedented liquidation.

The historical context surrounding such substantive losses in OI suggests a potential shift in market sentiment, with traders increasingly cautious as they assess the risks of leveraged trading in this volatile environment. A clear analysis should not only focus on immediate market impacts but also speculate on long-term trends manifested through such significant liquidations, indicating broader shifts in participant behavior and market dynamics.

In conclusion, Friday’s massive liquidation event serves as a critical reminder of the volatility inherent in cryptocurrency markets. This event led to historic changes in open interest, reflecting both immediate market dynamics and potentially signaling deeper changes within trader sentiment. As the industry navigates these challenging waters, participants will need to remain vigilant, carefully monitoring market indicators and ready to adapt to the rapidly evolving landscape of digital finance.