Have Bitcoin Treasury Companies Failed the PIPE Model?

The recent decline in share prices of notable Bitcoin treasury companies, specifically KindlyMD (NAKA) and Strive (ASST), raises important questions about the efficacy of the PIPE (Private Investment in Public Equity) financing model. Traditionally, PIPE allows institutional investors to buy discounted shares directly from publicly listed companies, enhancing capital-raising efficiency without the time-consuming nature of conventional public offerings. However, as observed in these cases, the PIPE structure may be failing to generate sustainable shareholder value and is leading to rapid capital erosion.

The PIPE Model Explained

The PIPE model has emerged as a considerable funding mechanism, particularly for companies heavily investing in Bitcoin treasures. This method enables firms to quickly amass resources for acquisitions or expansion, notably for companies exploring reverse mergers or SPACs (Special Purpose Acquisition Companies). By offering shares at reduced rates, companies can obtain substantial funding swiftly. However, the recent downturn in market performances for PIPE participants like NAKA and ASST indicates that the strategy may possess intrinsic risks that warrant careful consideration by investors.

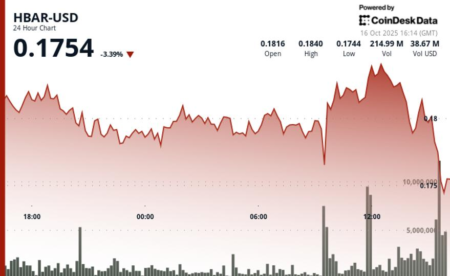

A Closer Look at KindlyMD (NAKA)

Take the case of KindlyMD (NAKA), which completed a reverse merger in May 2025. Following this, the Bitcoin treasury company Nakomoto transitioned into a wholly-owned subsidiary, with notable Bitcoin advocate David Bailey at the helm. A PIPE transaction raised $563 million intended primarily for Bitcoin purchases, supplemented by a convertible note deal that brought total financing to $763 million. Despite this ambitious capital deployment, where NAKA accumulated thousands of Bitcoin, the stock has plummeted over 95% from its high of $30 to around $0.80, highlighting a stark disconnect between capital raised and market performance.

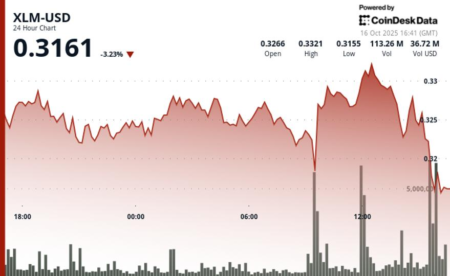

The Strive Example

Similarly, Strive (ASST), co-founded by Vivek Ramaswamy, leveraged a PIPE strategy to raise $750 million while merging with Asset Entities. The company made headlines with a PIPE priced at a premium to its pre-merger stock price, intending to purchase nearly 6,000 Bitcoin. Despite Strive’s ambitious acquisition strategies and additional debt-free financing options, its stock has also fallen more than 90%, from around $12 to nearly $1 per share. Like NAKA, Strive’s market net asset value (mNAV) is now hovering around 1, indicating underperformance in market valuation relative to its assets.

Caution Ahead for Future PIPE Deals

The disappointing performance of NAKA and ASST raises concerns regarding other anticipated PIPE/SPAC deals in the Bitcoin realm. For example, Twenty One Capital (XXI), led by Jack Mallers, announced a PIPE transaction in April, marking it as one of the largest Bitcoin treasury firms. Although initially buoyed by optimism following its merger, the firm’s share price has retreated from a peak of $60 to roughly $20. Similarly, Bitcoin Standard Treasury Company (BSTR) aims to raise $3.5 billion through a SPAC merger, with shares having already lost value since the announcement. Such trends signal a cautious environment ahead for investors in these PIPE-driven initiatives.

Risks Involved in PIPE Financing

While PIPEs offer a path to accelerated funding, they come with inherent risks that cannot be ignored. Rapid capital accumulation does not always correlate with long-term shareholder value. With companies like NAKA and Strive experiencing significant declines despite their funding successes, prospective investors should be circumspect about entering PIPE deals. The inflated valuations, initial excitement, and eventual downturn showcase the volatility and unpredictability of combining PIPE structures with Bitcoin investments.

Conclusion: A Need for Due Diligence

The heavy losses suffered by PIPE-based Bitcoin treasury companies highlight the potential drawbacks of this financing model. Investors should approach such opportunities with a keen sense of caution, conducting thorough due diligence before engaging. As the Bitcoin landscape evolves, understanding the risks associated with financial strategies like PIPE will be crucial for safeguarding investments against unforeseen market fluctuations. As these examples illustrate, while PIPE transactions can facilitate swift capital access, they can equally catalyze swift capital loss.