Ripple Labs Drives Towards a $1 Billion XRP Treasury Initiative

Ripple Labs, a key player in the cryptocurrency market, is making headlines with its ambitious goal of raising at least $1 billion to form a digital asset treasury, specifically targeting the accumulation of XRP. Despite recent turbulence within the crypto ecosystem, Ripple’s efforts symbolize a fortified commitment to their long-term strategy. The announcement, reported on October 17, 2025, highlights Ripple’s plans to utilize a Special Purpose Acquisition Company (SPAC) for this fundraising initiative, alongside contributing a portion of its own XRP holdings. This bold move signals Ripple’s determination to thrive amid challenges, signaling confidence in the future of digital assets.

The formation of this digital asset treasury (DAT) could potentially mark a significant development within the cryptocurrency domain, as it aims to establish the largest XRP treasury to date. Notably, rival companies Trident Digital and Webus International are also pursuing treasury projects, with respective fundraising goals of $500 million and $300 million. Ripple’s initiative not only showcases its leadership in the industry but also reflects a broader trend among crypto firms to explore innovative financial models despite the pressuring realities of the current market.

In conjunction with this treasury initiative, Ripple is strengthening its corporate footprint through its recent acquisition of GTreasury, valued at $1 billion. This move provides Ripple an avenue to explore the expansive trillion-dollar treasury market, primarily focusing on enhancing corporate liquidity management systems globally. GTreasury specializes in providing solutions for treasury management, and the collaboration between both firms aims to harness blockchain technology to modernize how companies manage liquidity, ultimately facilitating real-time cross-border payments that compete on cost and efficiency.

Ripple’s CEO, Brad Garlinghouse, emphasizes that merging blockchain capabilities with treasury management expertise opens doors for immense opportunities in the $120 trillion corporate treasury payments market. This acquisition aligns with Ripple’s overarching strategy to integrate technology into traditional financial processes, preserving its competitive edge in the rapidly evolving financial landscape. However, it also illustrates the emerging acceptance of cryptocurrencies as vital assets within corporate treasury frameworks, albeit with Bitcoin and Ethereum continuing to dominate the discourse.

The interest surrounding XRP has seen an uptick among institutional investors this year, although it remains a mixed narrative in the corporate treasury sector. While a few enterprises have considered XRP as a potential treasury reserve asset, Bitcoin and Ethereum continue to set the benchmark for digital asset investments in corporate portfolios. The overall reception toward crypto for treasury applications has slowed recently, as some firms grapple with their enterprise values dropping below their crypto holdings, raising questions about the sustainability of the DAT model.

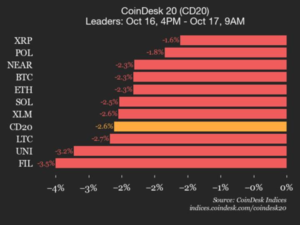

Amidst these developments, XRP’s market performance has shown volatility, with a recent pricing decline of 3% in the last 24 hours, currently trading around $2.35. Speculation and trading activity have increased, with the trading volume surging by 34%, indicating a renewed interest among traders. Data reveals a notable uptick in the derivatives market, with XRP futures open interest climbing over 2% within a four-hour window. Although the cryptocurrency market is characterized by its highs and lows, Ripple’s concerted efforts to establish a robust treasury initiative may set the stage for a renewed phase of growth and innovation in the digital asset domain.

In conclusion, Ripple’s strategic course toward creating a significant XRP treasury, alongside the acquisition of a treasury management firm, showcases a multifaceted approach to navigating the dynamic landscape of cryptocurrency. This initiative underscores Ripple’s confidence in the value of XRP within the larger framework of digital assets while addressing the pressing need for modernized treasury solutions. As Ripple strives to build a formidable presence in the treasury market, its initiatives could pave the way for broader adoption of cryptocurrencies in corporate financial strategies, thereby shaping the future of digital asset integration in traditional finance systems.