VanEck Leads the Charge with Preliminary Application for Lido Staked Ethereum ETF

In a landmark move, VanEck has filed a preliminary application for a Lido Staked Ethereum ETF with the U.S. Securities and Exchange Commission (SEC). As the first issuer to introduce this type of exchange-traded fund, VanEck’s decision underscores a significant step towards mainstream adoption and regulation of cryptocurrency investments. The application, officially submitted via an S-1 form on October 16, marks a pivotal moment for both the firm and the broader cryptocurrency market.

Understanding the Lido Staked Ethereum ETF

VanEck’s application follows a recent registration of a statutory trust for the Lido Staked Ethereum ETF in Delaware, with the CSC Delaware Trust Company acting as its registered agent. This innovative ETF aims to provide regulated exposure to Ethereum (ETH) and the potential staking rewards that can be earned through Lido’s liquid staking protocol. The ETF is designed to track the spot price of Lido Staked Ethereum (stETH) based on MarketVector’s Lido Staked Ethereum Benchmark Rate index, establishing it as a unique investment vehicle in the growing DeFi (Decentralized Finance) sector.

The Role of Lido in Ethereum Staking

Lido’s protocol enables users to stake ETH without needing to operate their own validator nodes, resulting in the issuance of the stETH token. This token is designed to represent both the deposited ETH and the rewards from staking. With a significant amount of ETH already staked on the platform—approximately 8.49 million ETH valued at over $33.37 billion—Lido holds an impressive market share of nearly 60%. This positioning highlights Lido’s influence within the Ethereum ecosystem and the broader staking landscape.

Implications of the SEC’s Generic Listing Standards

The SEC will review the Lido Staked Ethereum ETF application under its newly established Generic Listing Standards, which streamline the approval process significantly. Traditionally, the approval timeline for crypto ETFs under the Securities Act of 1933 could span 240 days, but the new standards have reduced this to just 75 days. This expedited process could expedite the introduction of Ethereum staking products to the market, adding further credibility and interest to the crypto ETF landscape.

Market Reactions and StETH Price Dynamics

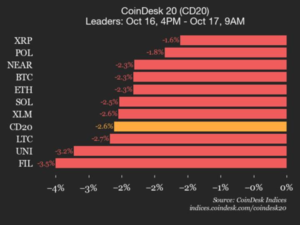

Upon the announcement of the Lido Staked Ethereum ETF application, market reactions were tepid. The price of Lido Staked ETH (stETH) experienced a decline of over 3%, settling around $3,867.53. The 24-hour trading range saw a low of $3,835.96 and a high of $4,066.89, indicating market volatility. Despite this decline, trading volume surged by 40%, suggesting cautious trading strategies among investors amidst the recent uncertainties in the crypto market.

The Broader Context for Cryptocurrency ETFs

The crypto community is currently awaiting the SEC’s ruling on the potential for staking within spot Ethereum ETFs. This decision has become increasingly critical—partly delayed due to the ongoing U.S. government shutdown. Recently, Grayscale achieved a milestone by enabling staking in its Ethereum Trust ETF (ETHE) and Ethereum Mini Trust ETF (ETH), making them the first U.S. crypto exchange-traded products to offer such functionality. Nevertheless, these ETFs have registered relatively modest inflows compared to their counterparts, reflecting the market’s reserved optimism towards cryptocurrency-focused investment products.

Conclusion: What Lies Ahead for the Crypto ETF Market

VanEck’s preliminary application for a Lido Staked Ethereum ETF represents a significant advance in the evolving world of crypto ETFs. By providing regulated access to Ethereum and its staking rewards, this ETF could appeal to a broad range of investors, enhancing market participation in digital assets. As stakeholders await the SEC’s decision and navigate the challenges posed by current market dynamics, the anticipation surrounding this application underscores the critical intersection of regulation and innovation within the cryptocurrency landscape. The potential approval of Lido Staked Ethereum ETF could pave the way for future ETFs, further integrating digital assets into mainstream investment portfolios and solidifying the role of staking in the financial ecosystem.