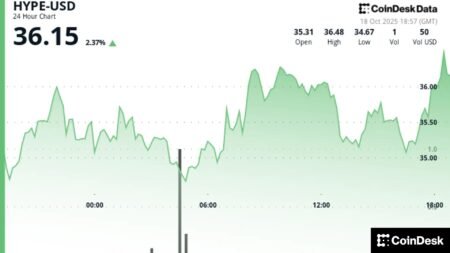

Ethereum’s Strategic Momentum Amidst Bitcoin’s Rally

As we delve into the current state of the cryptocurrency market, the dynamics between Ethereum (ETH) and Bitcoin (BTC) reveal nuanced trends that suggest a growing institutional interest in ETH despite BTC’s recent rally. October has seen ETH outperforming BTC in terms of net gains – with ETH securing a 7.02% gain compared to BTC’s mere 4.34%. This relative strength raises critical questions about the shifting investment strategies among institutional players.

Understanding Ethereum’s Resilience

During the early weeks of Q4, Bitcoin experienced an impressive rally, reaching an all-time high of $125,000. However, when assessing the overall performance, Ethereum has only declined by 6.94%, while Bitcoin merely edges out with a 1.15% gain. Notably, Ethereum’s strong performance in the first week of October, where it surged by 15%, illustrates its inherent resilience and capacity to withstand setbacks. The technical analysis indicates that, even as BTC faces downward pressure, ETH maintains its foothold by holding onto gains made in August, showcasing potential for upward momentum.

Indicators of Institutional Interest

A deeper analysis reveals that institutional players seem to be strategically rotating their investments toward Ethereum. Recent data illustrates that institutional investments in ETH are not merely short-term plays but reflect a broader strategy. BlackRock’s recent activities—moving significant amounts of BTC while simultaneously accumulating ETH—serve as a key example of this strategic shift. Their engagement is evidenced by a calculated approach, highlighted by their movement of over 300 BTC alongside the acquisition of 12,400 ETH from platforms like Coinbase Prime.

The Stablecoin Supply Surge

Adding another layer to this thesis is the noticeable rise in Ethereum’s stablecoin supply. Recent figures indicate a 2.18% increase over a week, amounting to $3.47 billion and pushing the total stablecoin supply on Ethereum to an all-time high of $163 billion. This influx signals an expanding liquidity pool within the ecosystem, positioning Ethereum favorably for future price movements. The influx of capital suggests that entities are actively preparing for longer-term strategies rather than engaging in fleeting trades.

Analyzing the ETH/BTC Ratio

The technical perspective of the ETH/BTC ratio further substantiates the possibility of a significant shift in market dynamics. Currently, the ratio is on the verge of achieving its first weekly gain, rebounding nearly 9% from recent lows. This uptick hints at a potential breakout for ETH against BTC, suggesting that Ethereum’s recent performance lag could primarily be a short-term phenomenon. Investors are collectively eyeing this critical resistance level, as a breakout could signify sustained momentum for Ethereum.

Future Outlook and Investor Strategy

In conclusion, the evolving landscape of institutional investment in Ethereum, highlighted by strategic moves from significant players like BlackRock, indicates a growing confidence in ETH as a long-term asset. The combination of increased stablecoin liquidity and favorable technical indicators suggests that Ethereum might be poised for substantial growth, contrasting sharply with Bitcoin’s more volatile swings. As market analysis continues to evolve, Ethereum may solidify its position not just as a complementary asset to Bitcoin but as a dominant player in its own right. This evolving narrative will undoubtedly shape investment strategies moving forward, emphasizing the importance of remaining attuned to these critical market signals.

In summary, Ethereum’s relative strength against Bitcoin, coupled with strong institutional interest and increasing liquidity, paints a promising picture for the future of ETH, making it an appealing focus for both new and seasoned investors in the evolving cryptocurrency landscape.