Understanding Stablecoin Regulation: Insights and Insights

Stablecoins are gaining significant traction as governments and regulatory agencies worldwide work to establish a cohesive regulatory framework around them. These digital currencies aim to maintain price stability by being pegged to traditional fiat currencies or other assets. As this regulatory environment evolves, it is crucial for stablecoin projects and their users to stay updated on compliance requirements, especially regarding asset backing, audits, and interest payments.

Regulatory Framework Worldwide

Globally, a common theme is emerging concerning stablecoin regulation. Most regulations mandate that stablecoins must be backed by high-quality, reliable assets, ensuring user confidence and stability. In addition, routine audits are a strict requirement to promote transparency and accountability. One noteworthy aspect of this regulatory framework is a prohibition on issuing interest on stablecoin balances, a condition echoed in major regulations like the GENIUS Act in the U.S. and the Markets in Crypto-Assets (MiCA) regulation in the European Union. Similar legislation has been enacted in financial hubs like Hong Kong and Singapore, aiming to establish a secure environment for stablecoin transactions.

Challenges in Implementation

While these regulatory guidelines offer a structured approach, enforcing the prohibition on interest payments presents significant challenges. The core argument behind disallowing interest is to keep liquidity within established banking systems, where risk management is more transparent and controlled. However, whether disallowing interest effectively achieves this remains debatable. Some argue it merely drives users toward decentralized finance (DeFi) platforms, potentially leading to unregulated liquidity exits.

Workarounds and Evolving Practices

Interestingly, even without offering explicit "interest," crypto platforms are exploring creative methods to provide yields to users. These include reward systems that resemble interest rates, and automated mechanisms within exchanges, such as those provided by Metamask, which enable consumers to move assets seamlessly back and forth between stablecoins and yield-bearing offerings like AAVE. This capability makes it easier than ever for users to gain returns on their stablecoin holdings, circumventing the intent behind regulations.

Potential Future Implications

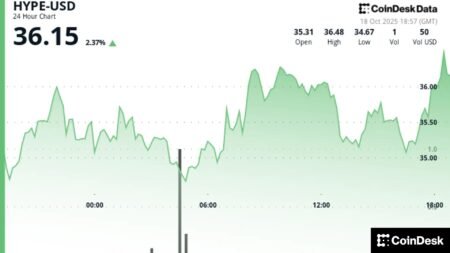

As regulations become stricter, one key point to consider is how this will affect the overall liquidity and movement of funds between stablecoins and interest-bearing opportunities. Users swiftly moving their assets, particularly during economic shifts, could lead to sudden and large-scale liquidations. This rapid influx and outflux of capital could destabilize the networks if triggered en masse, especially as the blockchain ecosystem continues to grow and mature. Currently, the transaction volume appears manageable, but a trajectory toward increased adoption may create substantial operational pressures on overall liquidity.

Emerging Alternatives: Tokenized Deposits

In cases where prohibitions on interest become effectively implemented, tokenized deposits could emerge as a popular solution. Advocates, including significant players like JPMorgan Chase, envision deposit tokens as a bridge between traditional banking and modern blockchain technology. These tokens represent claims on bank deposits while presenting opportunities for user yields, albeit with inherent counterparty risks. The current pilot program by JPMorgan exemplifies this initiative, focusing on creating a controlled, yet yield-generating asset.

History Reveals Patterns

Regulating interest payments for stablecoin balances echoes past financial regulations—most notably the U.S. Glass-Steagall Act enacted in 1933. Historical context reveals recurring complexities associated with enforcing interest prohibitions, which were ultimately modified to adapt to evolving financial landscapes. As banking and technology continue to merge, it raises an essential question: should we repeat the past rather than innovate? Providing flexible frameworks for stablecoin providers to offer interest could lead to more beneficial outcomes for the entire economic ecosystem, paving the way for a harmonized relationship between digital assets and traditional financial systems.

In conclusion, the ongoing development of a regulatory framework surrounding stablecoins highlights both potential benefits and challenges, emphasizing the importance of adaptability. As stablecoin technology evolves, stakeholders must navigate the balance between regulatory compliance and innovative financial practices.