Astra Nova Crash: A Closer Look at the 65% Decline in RVV Tokens

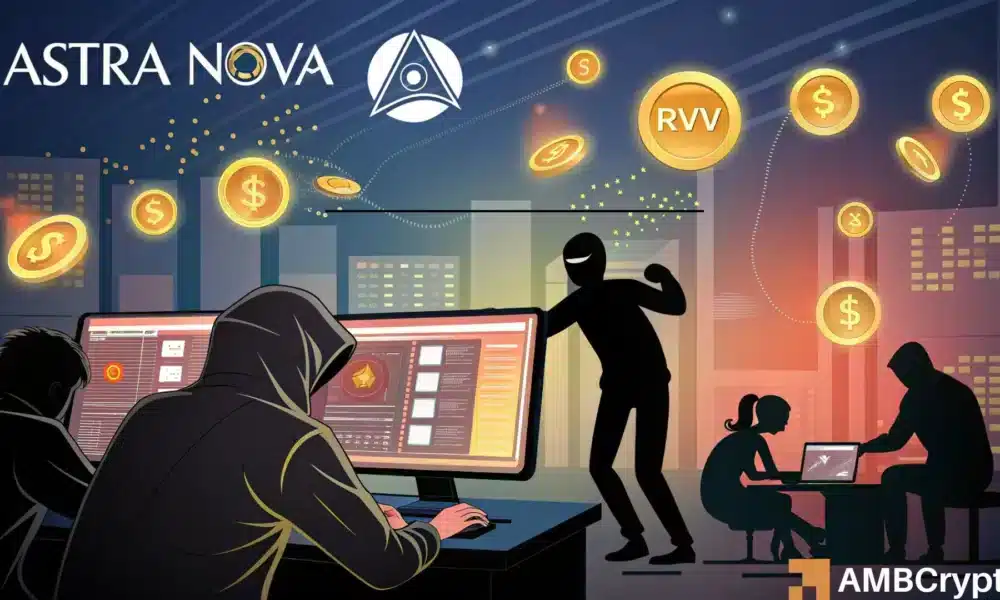

The cryptocurrency market is notoriously volatile, exemplified recently by the dramatic crash of Astra Nova (RVV) following its listing on Binance Alpha. Despite a promising surge that saw RVV reach an all-time high of $0.03, the token plummeted by over 65%, leading to concerns about its future. This article delves into the factors contributing to this sharp decline, the implications for investors, and the potential for recovery through strategic measures put forth by the Astra Nova team.

What Sparked the 65% Crash?

The immediate trigger for the 65% drop in RVV’s value was the sudden and coordinated sell-off executed by 18 wallets believed to be linked to hackers. According to reports from Lookonchain, these wallets dumped a staggering 890 million RVV tokens, valued at around $10.66 million. This massive sell-off not only triggered a price collapse but also resulted in a significant market cap reduction of 65%, bringing it down to $10 million. The abrupt capital outflow raised alarm bells within the community, creating a panic that further exacerbated the price drop.

The Role of Hacking in the Downfall

Adding complexity to the situation, the Astra Nova team attributed the sell-off to a malicious attack that compromised their third-party market-making (MM) account. Hackers reportedly gained access and began liquidating assets from the affected wallets, leading to a significant loss for investors. Despite the breach, the Astra Nova team claims that the blockchain infrastructure, including chains and smart contracts, remains secure. To address this issue, they are engaging forensic experts and law enforcement to retrieve lost funds, showing a commitment to restoring trust among their stakeholders.

Community Response and Strategic Initiatives

In response to the crisis, the Astra Nova team launched a token buyback program aimed at stabilizing the situation and instilling confidence in the community. This initiative involves repurchasing tokens directly from the open market to support affected investors. With promises of accountability and transparency, the team reassured stakeholders that they are committed to safeguarding their interests. Notably, a portion of the recovered funds will be allocated to the forensic teams assisting in the recovery efforts, a move designed to further align incentives.

Market Reactions and Investor Behavior

The fallout from the hacking incident ignited a wave of panic selling among investors. This was reflected in the skyrocketing of liquidated positions in the futures market, which totaled approximately $4.28 million over 24 hours. Among these positions, $2.28 million worth of long positions were liquidated, alongside $2 million worth of shorts. Interestingly, despite the plummeting prices, many traders on platforms like Binance and OKX continued to take long positions, indicative of a prevailing bullish sentiment. The Long Short Ratio remained notably high, suggesting that some investors still anticipate a rebound in prices.

Assessing the Recovery Potential for RVV

Whether RVV can recover from this setback hinges on multiple factors, primarily the effective implementation of security measures and the success of the buyback program. If the Astra Nova team can successfully address the security vulnerabilities that facilitated the attack, and if investor confidence can be restored through the buyback initiative, there is potential for RVV to rebound. Analysts speculate that should these conditions be met, RVV could aim for a recovery target of $0.012, even as current market conditions indicate a risk of further decline below the critical $0.01 support level.

Conclusion: Looking Ahead

The crash of Astra Nova underscores the fragility of crypto assets in the face of security threats and market manipulation. As the Astra Nova team works to address the issues and implement recovery strategies, it is imperative for investors to stay informed and cautious. Maintaining a balanced perspective amid market volatility will be essential for future investments. Ultimately, while the path to recovery appears challenging, Astra Nova has taken significant steps toward rebuilding trust and stability within its community. The engagement of forensic experts and the launch of a token buyback program reflect a robust approach that could pave the way for RVV’s resurgence in the competitive cryptocurrency landscape.

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-450x270.webp)