The Future of Altcoins: Insights on ETH and SOL amidst Bitcoin’s Uncertainty

The cryptocurrency market is currently experiencing caution, with altcoins like Ethereum (ETH) and Solana (SOL) showing signs of potential recovery. Financial analysts, including the well-known John Bollinger, suggest that both ETH and SOL may have reached a local bottom. However, the unpredictability surrounding Bitcoin (BTC) could impede a broader market rebound. In this article, we’ll explore the current scenarios for altcoins, the mixed opinions on Bitcoin’s trajectory, and what it means for investors.

Altcoins Showing Resilience

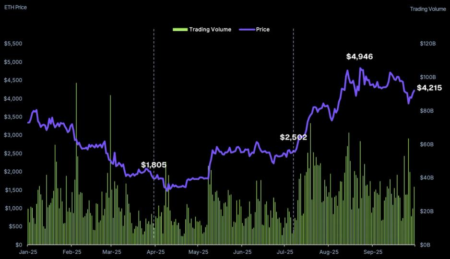

Despite prevailing market skepticism, leading altcoins such as ETH and SOL have shown resilience. Recent market analysis highlights that both coins may have formed a "W" shape pattern, often considered a precursor to recovery. Bollinger indicates that while SOL managed to defend its support at $180, ETH secured meaningful support around $3600. These patterns suggest that altcoins could be primed for recovery if the overall market conditions improve. However, they remain tethered to Bitcoin’s direction, as BTC usually leads market trends.

Bitcoin’s Crucial Support Levels

Bitcoin’s short-term outlook remains contentious among analysts. It has recently breached important support levels, raising concerns about its future price action. According to strategies employed in technical analysis, the $100K mark has emerged as a significant battleground for bullish and bearish sentiments. While some analysts express optimism if BTC retraces to this level, others remain skeptical, highlighting that BTC must reclaim levels above $112K to indicate a sustainable bullish trend.

De-leveraging and Market Sentiment

The recent market de-leveraging has introduced complexities but also potential opportunities for altcoin recovery. A substantial $19 billion was wiped off in liquidations, clearing the market of excessive leverage that had contributed to volatility. The CoinGlass Derivatives Risk Index (CDRI) provides valuable insight, revealing that it has reverted to a "neutral" state. This condition potentially sets the stage for altcoins to thrive, although market sentiment is still teetering on the edge of ‘fear.’ This presents a unique environment where strategic investments could lead to significant gains, provided traders exercise caution.

Panic Selling Across Altcoin Exchanges

The fear permeating the market has manifested conspicuously in altcoins, as evidenced by dramatic spikes in exchange inflows. These spikes often serve as indicators of panic selling and correlate with local tops in BTC. The market’s response has been visceral, and as analysts continue to debate Bitcoin’s short-term direction, altcoins are left to navigate a choppy environment. Should BTC find support and begin to recover, the hope is that SOL and ETH will benefit as well, following BTC’s lead.

Mixed Outlook Among Analysts

The fragmented opinions among analysts add another layer of uncertainty to the market. While some maintain a bearish outlook on Bitcoin, others wait for a critical price recovery before re-evaluating their positions. An analyst named Ansem indicated that he would remain pessimistic unless BTC reclaims the $112K mark. Similarly, Chris Burniske posited that he would engage with BTC only if it dips to $75K, marking $100K as essential support in the short term.

Conclusion: The Path Forward for Investors

As the cryptocurrency market wades through uncertain waters, astute investors must remain vigilant and adaptable. While leading altcoins like ETH and SOL show promise, their recovery seems intrinsically linked to Bitcoin’s performance. Analysts emphasize the importance of monitoring price action and adopting flexible strategies. By leveraging insights from de-leveraging events and understanding market sentiment, investors can position themselves for potential growth while mitigating risk. As the market evolves, keeping a close eye on these dynamics will be crucial for navigating the altcoin landscape.

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-450x270.webp)