The Optimistic Outlook for Ending the U.S. Government Shutdown: Insights from Kevin Hassett

The ongoing U.S. government shutdown has been a pressing concern for investors and policymakers alike. Speaking on CNBC’s “Squawk Box,” White House economic advisor Kevin Hassett expressed optimism that the deadlock might be resolved within the week, offering a glimmer of hope for markets closely watching the political landscape. The shutdown, which has entered its third week, has raised alarms about its potential repercussions on various sectors and the broader economy.

Political Standoff and Market Implications

Hassett’s comments carry significant weight, particularly amid the rising tensions between Republicans and Democrats over funding priorities. The Trump administration is pushing for a short-term resolution to the shutdown under existing spending levels, while Democrats insist on incorporating additional funding for healthcare and extending key tax credits from the Affordable Care Act. This political standoff creates an atmosphere of uncertainty, not just for fiscal policy but also for market dynamics. Analysts are particularly cautious as the ongoing shutdown aligns with an important week for economic data releases, including the U.S. Consumer Price Index (CPI).

Federal Reserve Decisions on the Horizon

The unusual timing of the U.S. CPI release adds an extra layer of complexity to the situation. Investors are eagerly anticipating how these economic indicators may influence upcoming decisions by the Federal Reserve, especially given the growing sentiment that an interest rate cut may be on the horizon. Hassett pointed out that the administration may resort to "stronger measures" should negotiations falter, hinting at internal frustrations and the urgency to stabilize federal operations amid a backdrop of financial uncertainty.

Political Optics and the “No Kings” Protests

Hassett also shed light on the potential political dynamics at play, suggesting that optics are slowing down progress. He indicated that Democrats might be postponing a vote to reopen the government until after the weekend’s “No Kings” protests against President Trump, further complicating negotiations. However, he remains hopeful that the conclusion of such demonstrations could pave the way for renewed bipartisan cooperation, allowing for necessary compromises to break the impasse.

Pressure on Crypto Markets and Inflation Data

The implications of a prolonged government shutdown extend beyond traditional markets to the burgeoning cryptocurrency sector. Investors are particularly attuned to inflation data, as a decrease in the inflation rate might spark optimism over possible rate cuts, which could provide support for liquidity-sensitive assets, including cryptocurrencies. In this context, Bitcoin has shown renewed strength, revealing the interconnectedness between fiscal policy, economic indicators, and investor sentiment within the crypto sphere.

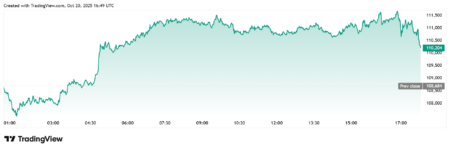

Prediction Markets Show Increased Optimism

Interestingly, data from prediction markets like Polymarket indicate a growing expectation that the government shutdown could end between October 23 and 26. This marks a significant rise in probability, increasing from below 10% just a week prior to around 35%. Conversely, the likelihood of a resolution after mid-November has dipped to approximately 27%, suggesting that market participants are beginning to factor in a potential breakthrough in negotiations sooner rather than later. The spike in trading volumes on Polymarket reflects a heightened investor focus on this critical fiscal issue, indicating that any forthcoming resolution could profoundly influence near-term market sentiment.

Conclusion: The Urgency for Bipartisan Resolution

As both parties grapple with the complexities of governance, the stakes have never been higher. A quick resolution to the government shutdown could provide relief not only to federal operations but also to financial markets eager for clarity. With skepticism surrounding political maneuvers and the upcoming economic data, investors remain watchful. As Hassett suggested, there’s hope that things could come together quickly—yet only time will tell if bipartisan cooperation can triumph over partisanship in these uncertain times. The outcome will undoubtedly shape the economic landscape in the coming weeks, making it an event worth following closely for investors and policymakers alike.