BlackRock’s iShares Bitcoin ETP Launch: A Game-Changer for UK Retail Investors

Introduction to BlackRock’s iShares Bitcoin ETP

On October 20, 2025, BlackRock launched its iShares Bitcoin ETP (IB1T) on the London Stock Exchange, marking a pivotal moment for retail investors in the UK seeking regulated exposure to Bitcoin. With this launch, individuals can access Bitcoin directly without having to deal with the complexities of holding or managing the cryptocurrency themselves. This article delves into the significance of this development, especially in light of recent changes in UK regulations and the evolving landscape of digital asset investments.

A Milestone for UK Retail Investors

The introduction of the iShares Bitcoin ETP represents a significant advancement for UK retail investors, as it offers them direct participation in one of the world’s most popular cryptocurrencies. Priced at $11.10 on its first trading day and achieving a notable 5.54% increase, IB1T provides a physically-backed option, ensuring that investments are tied directly to Bitcoin’s spot price. Moreover, BlackRock has announced an attractive total expense ratio (TER) of 0.15% per annum, which will increase to 0.25% after December 31, 2025. This cost-effective entry point could pique the interest of smaller investors looking to diversify their portfolios.

Impact of Regulatory Changes

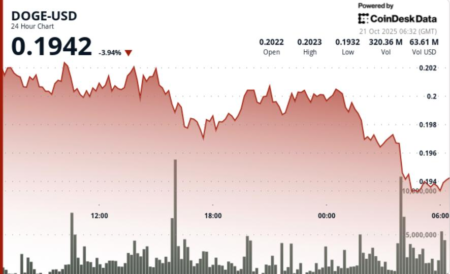

The launch of IB1T follows a significant policy shift from the UK’s Financial Conduct Authority (FCA), which has recently relaxed rules that previously hindered retail access to cryptocurrency-linked products. This shift represents a more pragmatic approach towards digital assets, aligning the UK market with its counterparts in the U.S. and Europe, where similar products have already gained traction. With Bitcoin recently trading around $110,000 after a period of volatility, the availability of such investment vehicles may help stabilize market dynamics and restore investor confidence.

UK’s Place in the European Market

With the introduction of BlackRock’s ETP, the UK joins an expanding list of European countries that already host Bitcoin ETPs, including Germany, Switzerland, and France. Companies like WisdomTree, 21Shares, and CoinShares are prominent players in the European market, and BlackRock’s entry signifies a new level of competition among traditional financial institutions within the rapidly evolving digital asset space. As regulatory frameworks become increasingly robust, financial heavyweights are now vying for a piece of the crypto investment landscape, signaling a maturation of the market.

BlackRock’s Expanding Digital Portfolio

The iShares Bitcoin ETP is just one component of BlackRock’s broader commitment to digital assets. The firm also offers a U.S.-listed Bitcoin ETF, an Ethereum ETP, and the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This concerted effort to diversify its digital asset offerings demonstrates BlackRock’s belief in the future of cryptocurrencies and their integration into mainstream finance. With the UK’s opening to regulated crypto investing, BlackRock is positioning itself strategically to become a leading player in this burgeoning space.

Conclusion: A Benchmark for Bitcoin Exposure

As BlackRock’s iShares Bitcoin ETP gains traction among investors, it could potentially serve as a benchmark product for retail Bitcoin exposure in the UK, one of the world’s most prestigious financial centers. The combination of a regulated environment, competitive pricing, and an established name like BlackRock provides a compelling proposition for retail investors eager to enter the crypto market. With more institutions backing diverse digital assets, the future looks promising for both investors and the overall evolution of cryptocurrency in traditional finance.

In summary, BlackRock’s iShares Bitcoin ETP launch is a watershed moment for the UK investment landscape, paving the way for broader retail participation in digital assets while signaling a shift in regulatory attitudes. This development not only provides a new investment opportunity for UK citizens but also emphasizes the growing convergence between traditional finance and innovative blockchain technologies.