U.S.-China Trade Tensions Impact Bitcoin Market: What You Need to Know

In recent developments, U.S. President Donald Trump has expressed uncertainty about his upcoming meeting with Chinese President Xi Jinping, resulting in significant implications for the financial market, particularly Bitcoin. As Trump hinted that the anticipated meeting may not occur, the cryptocurrency market reacted abruptly with Bitcoin’s price experiencing a sharp decline. This article elaborates on these events, their impacts on the Bitcoin market, and the broader implications on U.S.-China trade relations.

Trump’s Doubts on China Meeting

While speaking at the Rose Garden Club Lunch, President Trump hinted that the much-anticipated meeting with President Xi Jinping could fall through. This revelation comes on the heels of his earlier confirmation of their meeting, scheduled for October 31 at the APEC summit in South Korea. Trump emphasized his desire for a favorable deal with China, suggesting optimism about negotiations, but his recent remarks sowed doubts about their feasibility. These comments have crucial implications, as the outcome of their discussions could determine the direction of U.S.-China relations and impact global markets significantly.

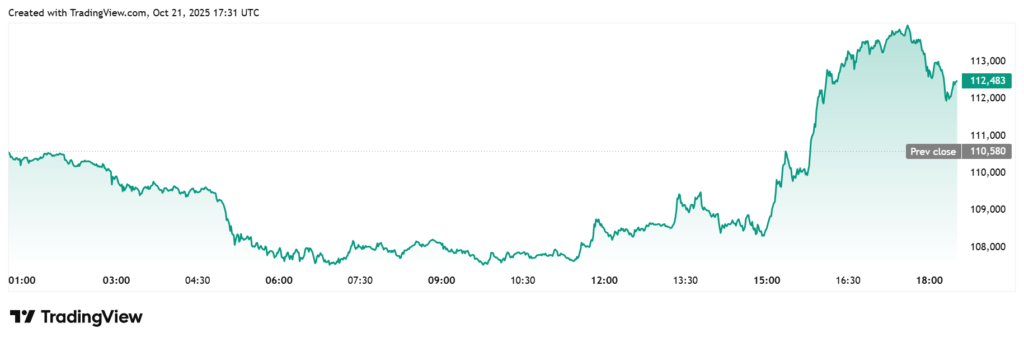

The Impact on Bitcoin Prices

Following Trump’s announcement of uncertainty surrounding the meeting with Xi, Bitcoin experienced a notable drop in value. The cryptocurrency, which had been on an upward trend reaching approximately $114,000, fell sharply to around $113,000 following Trump’s remarks. Initially, Bitcoin had surged from an intraday low of approximately $108,000, but the sentiment shifted rapidly, reflecting traders’ concerns about the broader economic implications of the stalled negotiations between the two global superpowers. Despite this pullback in price, Bitcoin has begun to recover and appears to be moving back towards the $113,000 level.

Trade Tariffs and Economic Woes

Trump’s comments coincided with his warning that he might impose a hefty 155% tariff on China if a trade deal is not reached before the November 1 deadline. This follows his earlier imposition of a 100% tariff, also set to take effect on the same date. These tariffs highlight the instabilities in U.S.-China trade relations, which have far-reaching impacts on global economies. As tensions escalate, markets, including cryptocurrencies, may face volatility, causing investors to reassess their positions and navigate potential risks accordingly.

Market Rotations: From Gold to Bitcoin

Interestingly, the recent fluctuations in Bitcoin prices have occurred amid a significant decline in gold, marking its largest daily drop since 2013. This may indicate a shift in investor behavior, with some traders potentially rotating out of gold and into Bitcoin as they seek alternative investment opportunities. With gold having recently reached an all-time high of over $4,300, its decline might have led investors to explore Bitcoin’s perceived advantages, such as its decentralized nature and potential for growth in times of economic uncertainty.

Bullish Sentiment Amid Uncertainty

Despite the recent volatility triggered by Trump’s statements, the general sentiment around Bitcoin remains somewhat bullish. The earlier rally sparked optimism among traders that a new bull market could be on the horizon for Bitcoin. As investors assess the implications of trade negotiations and global fiscal policies, many experts believe that Bitcoin’s unique characteristics as a digital asset can provide a hedge against traditional market disruptions, making it an appealing option for diversifying investment portfolios.

Conclusion: The Road Ahead

The ongoing tumult in U.S.-China trade relations and President Trump’s latest comments leave the financial markets in a state of flux, especially concerning cryptocurrencies like Bitcoin. As stakeholders navigate the challenges posed by potential tariffs and stalled negotiations, the impacts on market sentiment are palpable. It’s crucial for investors to remain informed and agile in these turbulent times, as the interplay between trade dynamics and digital currencies could significantly shape the future landscape of investment opportunities.

In summary, as the geopolitical landscape continues to evolve, the cryptocurrency market, led by Bitcoin, may remain a focal point for investors looking to mitigate risks while capitalizing on potential growth.