The Recent Volatility of Hedera’s HBAR Token: An Analysis

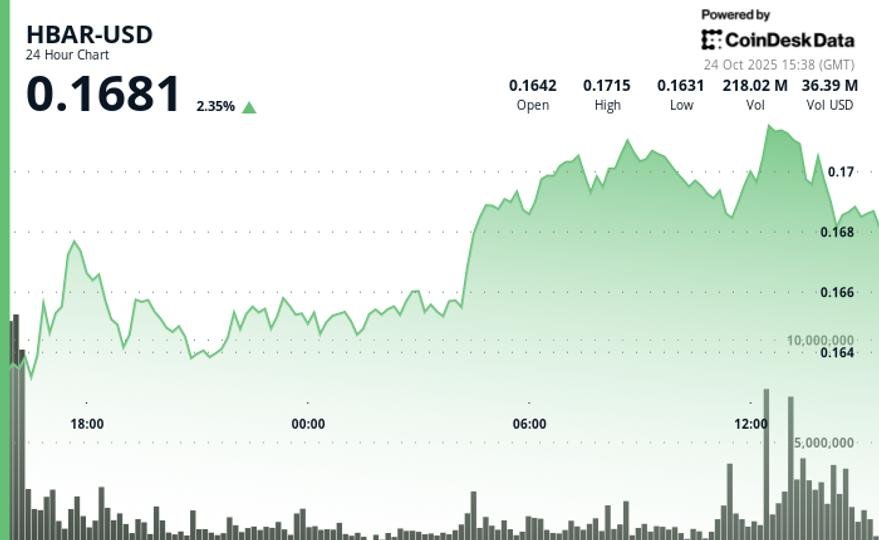

The cryptocurrency market is notorious for its volatility, and the recent fluctuations in Hedera’s HBAR token are a striking example. In the last 24 hours, HBAR experienced a decline of 1.7%, retreating from $0.1669 to $0.1697. This movement occurred within a narrow trading range of $0.0089, indicating the struggles buyers faced to sustain upward momentum. Key support at the $0.1633 level initially held, but it was unable to withstand the pressures of a weakening bullish structure, leading to a significant breakdown.

Understanding the Breakdown

The pivotal moment for HBAR occurred around 13:00 UTC when trading volume surged to 109.46 million tokens—an impressive 87% rise above the 24-hour average. This spike coincided with a strong rejection at the $0.1716 resistance level, which marked the onset of a selling spree. Following this surge, a follow-up spike of 4.72 million tokens at 13:39 validated a breakdown below the crucial support level of $0.170, indicating that the bullish trend may be shifting towards a distribution phase rather than a healthy correction.

Technical indicators now point towards changes in market dynamics. Repeated failed rebounds and declining highs signal that institutional investors could be playing a role in the current sell-off, a stark contrast to the typical patterns of retail investors who often amplify volatility in such markets.

Trading Patterns and Volume Analysis

A critical component in understanding HBAR’s recent activity is the volume analysis. The peak trading volume reached 109.46 million tokens, far exceeding the standard moving average of 58.5 million, confirming a distribution phase. Additionally, the breakdown volume spike observed at 13:39 further corroborated the weakening of the bullish structure, hinting that profit-taking by larger entities might be instigating the current downturn.

This sharp increase in volume also characterized the market’s volatility. A brief trading halt from 14:14 to 14:17 UTC, during which no transactions took place, added to the uncertainty. How HBAR resumes trading after such interruptions will be crucial in determining whether the bearish trend continues or stabilizes.

Key Support and Resistance Levels

Analyzing HBAR’s charts reveals essential support and resistance levels worth monitoring. The immediate resistance remains firmly at $0.1716, following a rejection that has established a formidable barrier for buyers. Meanwhile, the ascending trendline support was breached during the afternoon sell-off, leading to increasing bearish sentiment.

The base support level established at $0.1633 becomes critical moving forward. Traders should keep an eye on this level, as a breakdown below could open the door to more significant declines. On the other hand, maintaining stability above this support could provide a basis for potential recovery.

Market Behavior and Risk Management

From a trading perspective, utilizing sound risk management strategies becomes paramount in such turbulent market conditions. For traders looking to position themselves for short-term bearish trends, keeping risk parameters above the $0.1716 resistance will be vital. Failure to do so could exacerbate losses if the market swings unexpectedly.

The recent trading halt serves as a reminder that news and sentiment shifts could trigger quick market changes. Therefore, it’s essential to monitor both technical indicators and market sentiment continuously, adapting trading strategies as necessary.

Conclusion: Future Outlook for HBAR

The recent trading behavior of Hedera’s HBAR token illustrates the complexities of navigating a volatile cryptocurrency market. While the current bearish pressure signifies challenges for buyers, it also presents opportunities for traders willing to adapt to changing conditions. As the market awaits direction, close attention to key technical levels and continued volume analysis will be crucial for establishing the future trajectory of HBAR.

In summary, Hedera’s HBAR token is currently at a crossroads, reflecting wider trends in the cryptocurrency landscape. As volatility continues to reign, investors and traders alike must remain vigilant and informed, leveraging both technical analysis and market sentiment to navigate this complex environment.