Tom Lee’s Bullish Take on U.S. Stocks and Cryptocurrency through 2025

In a recent conversation with CNBC’s Jon Fortt on “Closing Bell: Overtime,” renowned market strategist Tom Lee expressed his optimistic outlook for U.S. stocks and cryptocurrencies through the end of 2025. As the chairman of Bitmine Immersion Technologies and head of research at Fundstrat Global Advisors, Lee emphasized that U.S. stocks are poised to close higher this year, driven by significant economic indicators and investor sentiment. His insights offer a compelling case for those looking to navigate the financial landscape in upcoming months.

Lee’s bullish stance comes in the wake of a spring slump, where he had previously set a year-end S&P 500 target of 6,600. Given that the index currently hovers around 6,800 with roughly ten weeks left in the year, Lee projects an additional 4% to 10% growth, potentially pushing the S&P above 7,000 by year-end. These projections are underpinned by Federal Reserve interest rate cuts that began in September, a trend reminiscent of occasions in 1998 and 2024. Lee believes that ongoing investor skepticism will act as a catalyst for late-year gains.

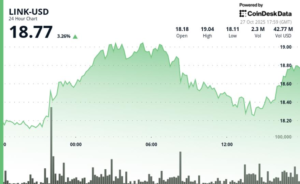

Navigating the intersection of cryptocurrencies and traditional equities, Lee noted that the recent market volatility has affected crypto assets as well. He identified October 10 as a significant liquidation event, driven, in part, by escalating U.S.-China trade tensions. However, he pointed out the resilience of Bitcoin, which only fell 3-4% during this turbulent time, suggesting it serves as a "pretty good store of value." Comparatively, if a similar contraction had occurred in gold, it would have been viewed as a validation of its stability.

Lee highlighted improving setups in the crypto market, notably that both Bitcoin and Ethereum are currently experiencing record lows in open interest—an indicator of outstanding derivatives positions. With technical indicators beginning to show positive trends, he is optimistic about potential upside movements. Additionally, he noted significant developments in traditional finance, exemplified by JPMorgan’s consideration of using cryptocurrency as collateral, which could signal greater acceptance and integration of crypto into the broader financial system.

When challenged on whether the crypto market still drives equity markets, Lee asserted that the signals look “pretty bullish.” He maintained that cryptocurrencies often provide early indicators for stock market movements and liquidity trends. He illustrated the correlation between Bitcoin’s performance and the S&P 500, while also pointing to Ethereum’s implications on smaller-cap stocks represented by the Russell 2000 index.

Beyond technical trends, Lee addressed the underlying fundamentals of Ethereum, reporting an uptick in activity on both Layer 1 and Layer 2. This growth, driven by stablecoins, may eventually reflect positively in pricing, reinforcing his conviction for a potential surge in both Ethereum (ETH) and Bitcoin (BTC) as the year draws to a close.

As U.S. stocks closed higher last Friday, the S&P 500 recorded gains of 15.73% year-to-date, showcasing a robust market environment. Additionally, as of Saturday, Bitcoin was priced at $111,776, while Ethereum was valued at $3,952—both demonstrating significant growth over the year. With Lee’s insights in mind, investors should remain vigilant for potential opportunities in both equities and cryptocurrencies, paving the way for a compelling year-end rally.

By synthesizing market trends, investor behavior, and macroeconomic indicators, Tom Lee underscores a favorable outlook for U.S. stocks and cryptocurrencies in the coming months. His analysis encourages investors to consider the implications of evolving market dynamics and prepare for potential market movements as 2025 approaches.