Insights on HYPE Investment from Analyst Pentoshi

Pentoshi, a pseudonymous analyst with a significant following on X, recently shared his insights regarding Hyperliquid’s native token, HYPE. On October 17, he disclosed that he initiated a modest position in HYPE, purchasing around 20% of the total stake he intends to hold. He strategically acquired the token below the $34 mark and mentioned plans to increase his holdings if prices decline further, particularly targeting the $28 to $30 range. This cautious approach underscores a preference for a gradual accumulation strategy rather than a full commitment at once, an essential tactic amid prevailing market uncertainties.

Market Conditions and Trading Strategy

Pentoshi highlighted that his investment strategy is contraligned with a broader downtrend in the market. By referring to "lower highs," he points out that each upward bounce in price has not been able to exceed the previous peaks, a classic hallmark of a bearish trend. This analysis illustrates the challenges currently faced by traders as market volatility may lead to further price declines. Pentoshi’s insights into "broken market structure" provide an important understanding of the weakening support zones that have developed due to recent market volatility. This condition can lead to exaggerated moves and sudden whipsaws, prompting caution among investors.

Staking and Market Dynamics

The analyst also noted a potential upcoming supply overhang related to an unstaking queue. In staking protocols, previously locked tokens periodically become available for sale, which, if not restaked, could trigger a short-term increase in selling pressure. Pentoshi admitted uncertainty regarding the extent of tokens entering the market post-unstaking, thus opting to set gradual buy orders below the current price rather than chase upward market trends. This conservative approach embodies prudent risk management vital in uncertain market conditions.

Learning from Past Experiences

In a candid admission, Pentoshi revealed that a recent ether trade that deviated from his standard rules resulted in minor losses, prompting him to adopt a more defensive trading position. His current strategy involves smaller trade sizes, pre-set buy orders, and minimal day-to-day management of existing positions. This disciplined approach indicates an understanding that emotional trading can lead to significant drawbacks, hence the shift towards a more methodical and pre-planned trading framework.

Hyperliquid’s Role in the Market

Hyperliquid stands as a decentralized exchange serving primarily for perpetual futures trading, which are derivatives without an expiration date. The HYPE token plays dual roles—facilitating governance and acting as an economic stake within the platform. Token holders can participate in governance decisions, reap staking rewards, and benefit from a revenue-sharing mechanism that ties the token’s value to trading activity as well as accumulated fees. By maintaining a crucial connection between user engagement and financial growth, Hyperliquid becomes a significant player within the decentralized finance landscape.

Current Market Overview and Future Outlook

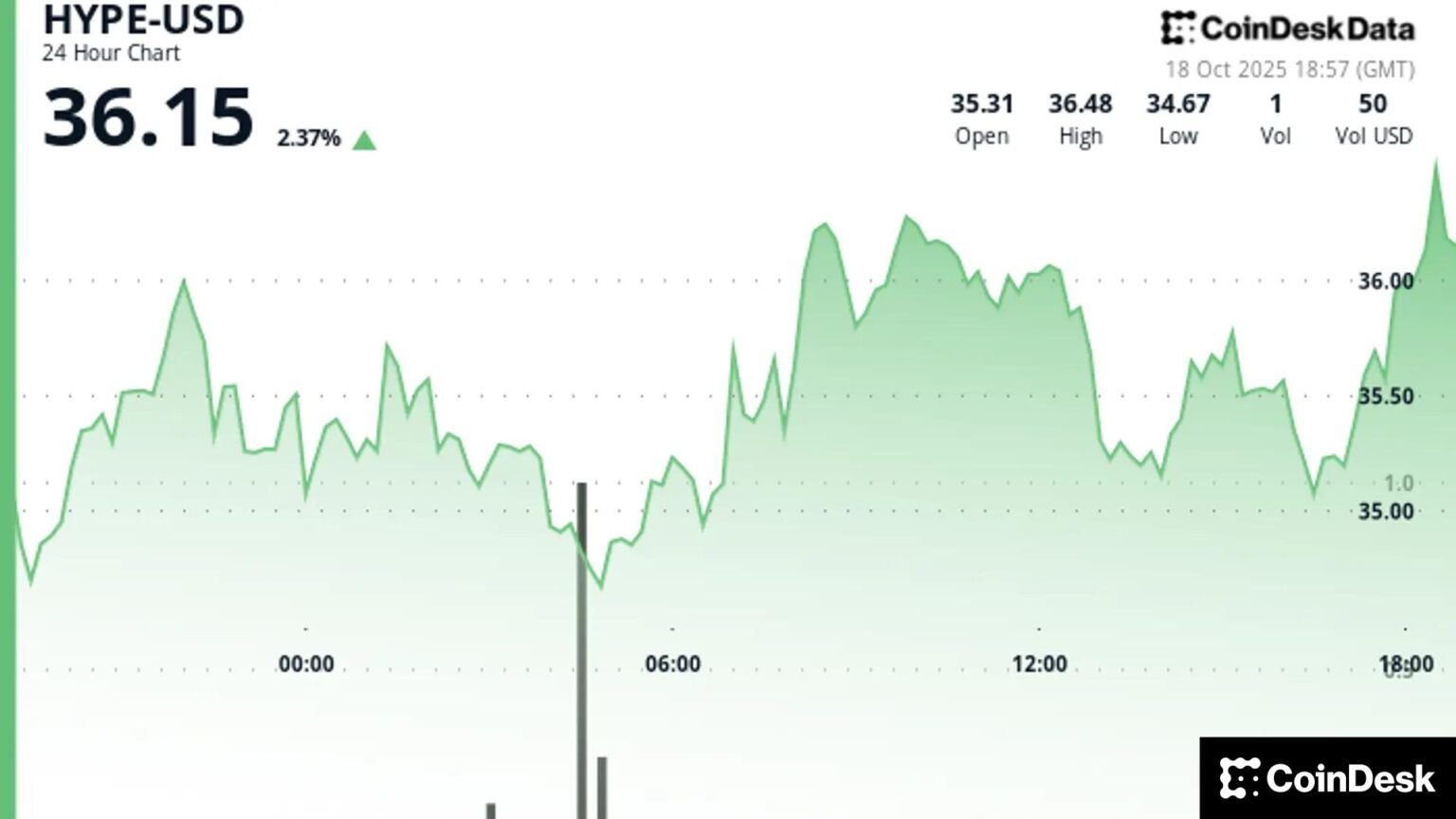

As of the latest updates, HYPE was trading around $36.32, marking a modest increase during the past 24 hours. This price movement reflects not only the token’s somewhat volatile nature but also the broader trends seen in the cryptocurrency market. As analysts like Pentoshi navigate these conditions, focusing on calculated risk management, trend analysis, and market psychology becomes paramount for success. Investors watch closely as narratives evolve, observing how strategies adapt to align with emerging trends and market realities.

In conclusion, Pentoshi’s recent insights on HYPE not only enhance understanding of the current market but also serve as a reminder that disciplined trading strategies and continuous learning from past experiences are essential in the fast-paced world of cryptocurrency investments. As the HYPE token and Hyperliquid continue to develop, the foundational principles of trading and market awareness remain ever-important for investors aiming to navigate this dynamic landscape.