Understanding Recent Bitcoin Trends: Active Addresses and Market Sentiment

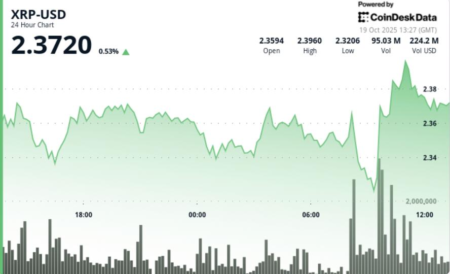

The cryptocurrency market is known for its volatility and rapid changes, and recent data highlights this phenomenon concerning Bitcoin (BTC), particularly regarding the number of active addresses depositing BTC to exchanges like Binance. On October 10th, BTC experienced a dramatic price drop from $121.5k to $102k. This sudden decline was mirrored by a surge in active addresses, indicating increased selling pressure. In this article, we will analyze these trends, explore the implications for traders, and discuss the short-term outlook for Bitcoin.

Spike in Active Addresses Indicates Selling Pressure

The spike in active addresses depositing Bitcoin into Binance reached approximately 64,000 on October 14th, signaling a significant uptick in selling activity. This figure was notably high, matching July’s influx when Bitcoin surpassed the $120k mark. Such an increase often points to panic-driven selling, indicative of traders offloading assets to mitigate losses during turbulent market phases. Following this peak, however, the number of unique addresses began to decline, dropping to about 30,850 by October 18th, suggesting that the selling pressure might be easing and that the market could be moving toward a new equilibrium.

The Bearish Short-Term Outlook

Despite some signs of potential recovery, the short-term outlook for Bitcoin remains largely bearish. Traders should exercise caution before making any aggressive bets on a price rebound. Analysis of recent liquidation heatmaps indicates that significant liquidation points have formed around price levels of $108k and $106.2k. Should Bitcoin break above $108k, it may trigger additional buying activity as liquidity clusters draw in more traders. However, the presence of leveraged positions in higher zones, specifically around $114k and $116.5k, suggests potential resistance levels that traders will need to consider.

Influence of External Economic Factors

Apart from technical indicators, broader economic factors could also affect Bitcoin’s price trajectory. Notably, a recent report from AMBCrypto pointed out a surge in China’s M2 money supply, which has historically shown a positive correlation with Bitcoin price movements. As liquidity in traditional markets increases, Bitcoin could stand to benefit, potentially leading to upward price momentum. Traders should remain vigilant to these external factors, as they can have profound implications for market sentiment and price action.

ETF Flows as a Sentiment Indicator

The current state of Spot ETF flows adds another layer of complexity to the analysis. Recently, these flows have been negative, mirroring the prevailing bearish sentiment within the market. Historically, positive shifts in ETF capital flows can often signal changes in public sentiment, serving as an early indicator for potential bullish reversals. If the ETF capital flow trends towards positivity, it could foreshadow a changing landscape for Bitcoin, creating more favorable conditions for traders looking to enter long positions.

Waiting for Clarity in Market Direction

Given the fluctuating market dynamics and mixed signals, traders should exercise patience. Jumping in too early on bullish bets could lead to substantial losses, especially if the bearish trend continues. The market appears to be at a crossroads, with factors both supporting a bullish reversal and those cautioning against premature optimism. Evaluating price levels closely, particularly around liquidity clusters, may provide clearer signals for when to make strategic entries or exits.

Conclusion

In summary, the recent spike in active addresses depositing Bitcoin to exchanges signals increased selling activity, leading to a bearish sentiment in the short term. While this trend has prompted caution among traders, external economic factors, such as shifts in China’s money supply and ETF flows, may ignite a potential bullish reversal in the future. As Bitcoin navigates this volatile landscape, it is essential for traders to remain informed, observe market trends, and develop a strategic approach—waiting for the right indicators before making significant decisions in this fast-moving market.

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-300x180.webp)

![Can Celestia [TIA] Bounce Back After Its Unlock? Spot Buyers Believe It Can, But…](https://cryptonewsinsiders.com/wp-content/uploads/2025/10/Abdul-7-1-1000x600.webp-450x270.webp)