Tether’s Valuation: A Deep Dive into the $515 Billion Projection

Recent commentary from Jon Ma, CEO of Artemis, has ignited a robust debate surrounding the potential market value of Tether, the leading stablecoin issuer. Ma’s assertion that Tether might achieve a staggering valuation of $515 billion if it were to go public positions the company in a rarefied air, surpassing major corporations like Costco and Coca-Cola. This article will explore the foundations of this valuation, Tether’s role in the crypto ecosystem, and what implications this could have for the broader financial landscape.

Understanding the $515 Billion Valuation

Jon Ma’s analysis is rooted in a series of comparisons and financial assumptions. Notably, he contrasts Tether with Circle, the issuer of USDC, which recently went public with a valuation of $30 billion. Based on Circle’s projected earnings before interest, taxes, depreciation, and amortization (EBITDA) of $410 billion for 2025—yielding a hefty 69.3x EBITDA multiple—Ma extends the same rationale to Tether. This projection leads to Tether’s estimated EBITDA of approximately $7.4 billion for 2025, which ultimately culminates in the $515 billion figure. Although thought-provoking, Ma himself cautions that the application of Circle’s EBITDA multiple to Tether might be a speculative leap, indicating the valuation’s inherent uncertainty.

Tether’s Financial Performance

Tether’s financial standing provides a compelling backdrop for these ambitious forecasts. The company reportedly earned $13 billion in net profits for 2024, with $7 billion generated from Treasuries and repos and another $5 billion from unrealized gains on Bitcoin and gold holdings. While these profits demonstrate Tether’s robust financial health, not all components were considered in the EBITDA calculations, prompting Tether’s CEO, Paolo Ardoino, to label the projection as “a bit bearish.” Ardoino acknowledges the charm of the $515 billion figure while emphasizing that their growing investments in Bitcoin and gold should be factored into any valuation.

The Role of USDT in Crypto Markets

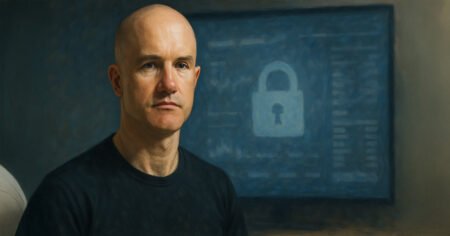

Since its inception, Tether has become a cornerstone of the crypto ecosystem, fundamentally serving as a liquid asset for trading, remittances, and acting as a stable store of value. The demand for Tether’s USDT has been steadily climbing, driving an ongoing increase in its supply. Thanks to Ardoino’s leadership, Tether has managed to maintain its status as the largest stablecoin by market capitalization, ranking third overall in the cryptocurrency hierarchy, trailing only Bitcoin and Ethereum.

Moreover, Tether’s integral role in bridging the gap between traditional finance and the cryptocurrency world cannot be overstated. Its stablecoins facilitate millions of cross-border transactions, allowing individuals and institutions seamless access to both markets. The expansion of Tether’s product offerings to include stablecoins pegged to various currencies, from euros to gold, further underscores its adaptability and relevance.

Transparency and Security in Operations

A key element to Tether’s success is its commitment to transparency and security. Ardoino has outlined various protocols to uphold the integrity of Tether’s operations. These measures include regular audits and a clear explanation of reserve management, primarily driven by interest income from assets like U.S. Treasuries. By prioritizing security and transparency, Tether continues to build trust with its users, essential for sustaining its large user base amid regulatory scrutiny.

Technological Innovations and Sustainability Initiatives

Beyond financial maneuvers, Tether is actively investing in technological advancements and sustainable energy initiatives. This strategic positioning reinforces its integration into the global economy, showcasing its potential to evolve in line with modern financial demands. As Tether remains an innovator, its efforts to engage with sustainable practices highlight an increasing awareness of corporate responsibility in finance.

The Future of Tether and Its Valuation

The hypothetical $515 billion valuation paves the way for intriguing conversations about the future trajectory of Tether and its place in the crypto and traditional finance realms. Whether this ambitious valuation could transition from a theoretical exercise to reality remains uncertain. Nonetheless, the ongoing discourse illustrates Tether’s considerable impact on both sectors, prompting stakeholders to consider what the future holds for Tether as it navigates a rapidly changing financial landscape.

In conclusion, Tether’s valuation, shaped by various financial metrics and market dynamics, speaks to its substantial influence in the intertwined worlds of cryptocurrency and traditional finance. As discussions evolve, industry watchers, investors, and cryptocurrency enthusiasts will keenly observe whether Tether’s aspirations for an IPO reflect the reality of its potential—strengthening its position as a significant player in global finance.