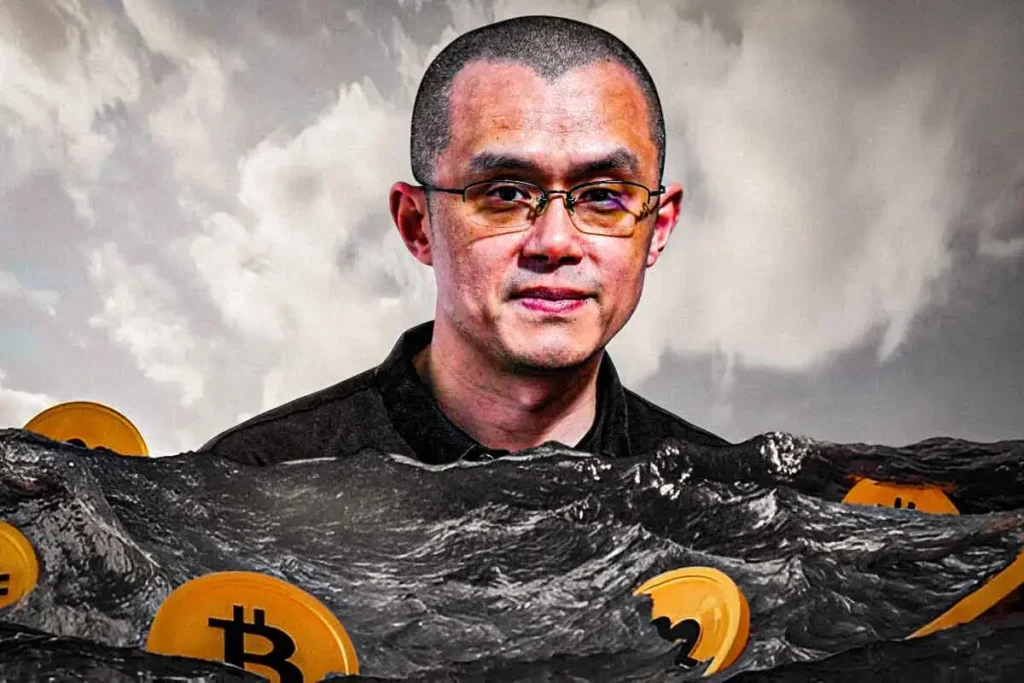

Changpeng Zhao’s Proposal for an On-Chain Dark Pool DEX: A New Era for Crypto Trading

Changpeng Zhao, the founder of Binance, has recently proposed the creation of an on-chain dark pool decentralized exchange (DEX) aimed at enhancing privacy for crypto traders, particularly for those trading futures. This call comes at a crucial time, following the significant fallout from the James Wynn liquidation saga, where he revealed his staggering $100 million loss due to a corrupt trading system. Zhao’s innovative proposal seeks to address the fundamental challenges of transparency that plague traditional DEXs and create a safer trading environment for all participants.

Understanding the Need for Privacy in Crypto Trading

In a world where transparency is often seen as an asset, the trading ecosystem has its complexities, especially in decentralized finance (DeFi). Zhao has drawn attention to the significant vulnerabilities that arise from publicly visible trades. He highlights two main issues: front-running and market manipulation, especially on perpetual contracts. In essence, onlookers can exploit visible orders, executing trades ahead of large buyers and amplifying slippage. This not only inflates trading costs but also erodes trust within the trading community. By proposing a dark pool model, Zhao aims to replicate the benefits seen in traditional finance (TradFi), where large investors often rely on private venues to mitigate these risks.

The Drawbacks of Existing DEXs

The existing DEX ecosystem is fraught with challenges that deter large traders. One major issue is the real-time visibility of orders, which allows malicious actors to manipulate the market to their advantage. Zhao’s concern extends to the coordinated efforts to trigger liquidations, where the public nature of liquidation points can lead to detrimental outcomes for traders. These risks, compounded with the volatility of the crypto market, create a landscape where many traders feel vulnerable. Zhao argues that the development of a dark pool DEX could safeguard against these vulnerabilities while offering the necessary privacy for high-stakes trading.

Dark Pool DEX: Key Features and Benefits

Zhao’s vision for a dark pool DEX includes features designed to prioritize trader privacy and security. Key elements of this proposed model include concealing order books and delaying the visibility of deposits into smart contracts. Additionally, he advocates for the use of advanced cryptographic techniques, such as zero-knowledge (ZK) proofs, which would secure transactions while maintaining confidentiality. This framework aims at fostering a more reliable trading environment that can withstand the challenges posed by market volatility and malicious intent.

Insights from the James Wynn Incident

The recent debacle involving James Wynn serves as a critical reminder of the vulnerabilities within the crypto trading landscape. After experiencing a massive liquidation and subsequently labeling the environment as "corrupt," Wynn emphasized the need for fundamental changes in the way crypto markets operate. His experience highlights the dangers associated with traditional exchange models that often protect their internal market-making operations rather than the interests of individual traders. This incident casts a harsh light on the conflicts of interest that arise when exchanges act as both facilitators and market participants.

The Shift Toward Private Exchanges

There is already a noticeable shift within the DeFi ecosystem, particularly on platforms like Solana, where private DEXs are becoming increasingly popular. Recent data points suggest that a significant portion of trades routed through platforms like Jupiter is executed via these private exchanges. As the crypto landscape continues to evolve, traders are recognizing the value in private platforms that prioritize confidentiality. Zhao’s proposal aligns perfectly with this trend, providing a robust framework for future development in the DEX space.

Conclusion: A Call to Action for Developers

Changpeng Zhao’s proposal for an on-chain dark pool DEX presents a compelling case for the future of decentralized trading. As the crypto environment becomes more complex, the need for enhanced privacy and security grows increasingly urgent. Zhao’s vision combines the strengths of traditional finance’s dark pools with the innovative potential of blockchain technology. He urges developers to seize this opportunity to build solutions that cater to the increasing demand for privacy, thus paving the way for a new era in crypto trading. As the industry evolves, it remains imperative for participants to adapt and innovate, ensuring a more secure trading ecosystem for all.