Cryptocurrency Recovery Rally: Bitcoin and Market Trends

The cryptocurrency market experienced a notable recovery rally on Monday, with major cryptocurrencies like Bitcoin and Ethereum showing impressive gains. This surge followed positive influences from traditional markets, namely Japan’s stocks reaching new heights and China’s GDP data exceeding expectations.

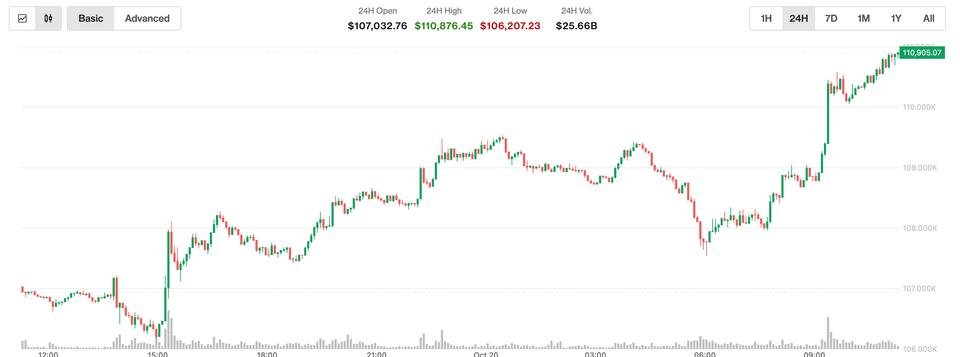

Bitcoin’s Resurgence

Bitcoin (BTC) once again captured market attention, climbing to over $111,000, marking a 3.7% increase within 24 hours. This price rally comes after a recent dip to $103,602. Such fluctuations are common in Bitcoin’s behavior, and this resilience suggests a potential bullish trend ahead. As the leading cryptocurrency, Bitcoin’s movements significantly influence the broader market, with altcoins such as Ethereum (ETH), XRP, Solana (SOL), and Binance Coin (BNB) also rising between 3% to 5% over the same period.

Market Dynamics

The CoinDesk 20 Index, which monitors a selection of digital assets, noted a rise of 3.6%, reaching 3,685 points. This upward trend was reinforced by Bitcoin’s RVT ratio— a key indicator used to assess market dynamics. A decline in the RVT ratio suggests that Bitcoin is actively being utilized and traded rather than just stored, hinting at a potential bullish phase for the asset.

Traditional Market Influences

Positive developments in regional stock markets are providing an encouraging backdrop for cryptocurrency enthusiasts. Japan’s Nikkei index surpassed 49,000 points for the first time, bolstered by fiscal policy signals favoring continued government spending and economic stimulus. This environment contrasts with the U.S. Federal Reserve’s anticipated interest rate cuts, which may stimulate investor interest in riskier assets like cryptocurrencies.

China’s Economic Growth

Adding to the favorable market atmosphere, China’s quarterly GDP data reported a year-on-year growth of 4.8%, surpassing the forecast of 4.7%. This economic performance appears to provide a boost to Chinese stocks, which rose by 0.90%. Investors are encouraged by this positive news, signaling potential stability and growth within the global economy.

Dollar Dynamics and Commodities

In addition to favorable stock performances, the dollar index slightly declined to 98.40, which supports dollar-denominated assets such as Bitcoin. The stability of gold prices at around $4,250 indicates possible exhaustion in its upward movement, historically correlating with Bitcoin’s resurgence. Thus, the interplay between the dollar, gold, and cryptocurrencies remains critical as investors navigate this fluctuating market.

Future Outlook

As the cryptocurrency market continues to gather momentum, fueled by positive economic indicators from leading economies, stakeholders and investors remain optimistic. The signs of increased Bitcoin activity combined with supportive economic environments in traditional markets suggest a promising outlook for the crypto landscape. With ongoing developments, both in traditional and digital asset spaces, the path forward for cryptocurrencies may well be filled with opportunity and growth in the coming months.