Current State of Bitcoin: Key Factors Influencing Its Momentum

Bitcoin (BTC), the world’s leading cryptocurrency, is experiencing a notable decline in net demand, which has fallen by 857,000 BTC despite significant purchases by institutional investors. This paradoxical situation indicates underlying weakness in the Bitcoin market, suggesting that the foundation for sustained growth is becoming increasingly fragile. As the price of Bitcoin hovers around $109,011, this latest rally lacks the robust transaction volume and retail interest typically observed during previous bull markets, raising questions about the sustainability of upward price movements.

Institutional Buying vs. Falling Demand

While institutions like ETF investors and MicroStrategy have cumulatively acquired 748,000 BTC, the overall market sentiment among retail investors appears to be waning. As institutional demand fails to compensate for the slipping interest from broader market participants, significant concerns arise regarding Bitcoin’s long-term prospects. This disconnect highlights the growing fragility beneath the surface, suggesting that the future momentum of Bitcoin could be threatened.

Whale Activity and Market Sentiment

Current trends in whale activity reveal a marked decline in confidence among large holders of Bitcoin. Net flows have plunged over 1,300% in just a week, showcasing a trend of mass withdrawals that contrasts sharply with any bullish narrative. Even during brief price surges, the tide of outflows has remained unaffected, indicating a structural hesitation among these influential investors. Although the price remains relatively stable, with a floor around $96,000 to $97,000, the elongated negative flow from large addresses raises serious concerns about BTC’s ability to achieve short-term gains.

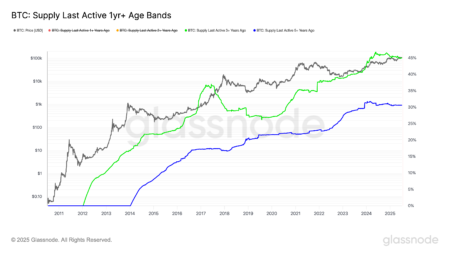

Shifts Among Long-Term Holders

Long-term holders of Bitcoin are showing signs of uncertainty, as indicated by a 7.06% increase in Coin Days Destroyed (CDD). This metric, which measures the lifespan of coins being spent, signals that older Bitcoin are being moved more frequently. Typically, this behavior suggests that seasoned holders are contemplating exits, introducing additional supply pressure into the market. If this trend continues, it could hinder Bitcoin’s efforts to reclaim all-time highs, further exacerbating the existing uncertainty.

Declining Transaction Activity

Another critical factor contributing to Bitcoin’s weakened momentum is the significant drop in on-chain transaction activity. Currently, transaction counts are at their lowest in months, with only 97,100 transactions recorded. This decline reflects a lack of retail engagement and on-network activity, undermining Bitcoin’s fundamental strength. While institutional buying has risen, stagnant usage across the broader network can diminish organic demand. Without increasing transaction volumes, Bitcoin’s bullish narrative becomes increasingly tenuous.

The Role of Derivatives and Funding Rates

Despite the challenging demand landscape, funding rates remained marginally positive at +0.008%. This slight uptick indicates a mildly bullish sentiment among derivatives traders; however, the value suggests limited conviction, as aggressive long positions are not being established. This subdued funding environment mirrors the low net demand and declining engagement from retail traders, further adding to the uncertainty enveloping the current market cycle.

Liquidation Risks and Future Outlook

The liquidation heatmap from Binance highlights zones just above the $110,000 mark where numerous traders have concentrated long positions with high leverage. Should Bitcoin’s price approach these levels, the likelihood of a liquidation cascade increases, which could generate volatility rather than a sustained breakout. Consequently, this creates a critical psychological and technical resistance that Bitcoin will need to overcome to maintain upward momentum. Without genuine demand driving these movements, it is increasingly difficult to see a path for Bitcoin to rally significantly.

In summary, Bitcoin finds itself at a critical juncture. While institutional investment may provide a semblance of stability, declining transaction volumes, negative whale activity, and shifting sentiments among long-term holders suggest that the underlying demand is waning. Unless these trends reverse, the chances for Bitcoin to achieve new all-time highs remain precarious.