Trump’s Tariff Threat and Its Fallout on the Crypto Market

U.S. President Donald Trump’s recent threat to increase tariffs on Chinese imports has sent shockwaves through the cryptocurrency market, particularly affecting Bitcoin. The premiere digital asset plummeted below the critical support level of $120,000 after Trump’s warning, which has ignited fears about heightened market volatility. This article delves into the implications of Trump’s statements on Bitcoin and the broader crypto landscape.

The Immediate Aftermath of Trump’s Comments

Following the announcement, Bitcoin dropped sharply from just above $121,000, illustrating how susceptible the cryptocurrency market is to geopolitical developments. In a post on his social media platform, Truth Social, Trump accused China of being "hostile" and attempting to monopolize key resources with export controls on rare-earth metals. He flagged the potential for imposing significant tariffs on Chinese products, a move that could exacerbate existing tensions and prove detrimental to Bitcoin and other cryptocurrencies.

Historical Context: Revisiting Previous Tariffs

Trump’s remarks evoke memories of previous tariffs that ignited a trade war between the U.S. and China. While both nations had previously sought a trade agreement that resulted in a pause on proposed tariffs, this recent escalation raises concerns for investors in risk assets like crypto. The present climate of uncertainty adds an additional layer of tension, further threatening Bitcoin’s stability and reflecting the interconnected nature of global markets.

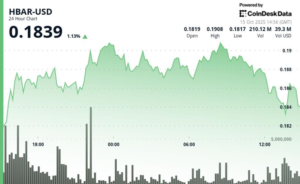

The Ripple Effect on Altcoins

The impact of Trump’s comments was not limited to Bitcoin alone. Other major cryptocurrencies, including Ethereum, Solana, XRP, and Dogecoin, also experienced significant declines. Ethereum dipped below $4,200, marking a decrease of over 3%. The market correction indicates how easily altcoins can be affected by broader market sentiments and political factors, showcasing the inherent risks involved in cryptocurrency investments.

Liquidations and Market Dynamics

In the wake of the downturn, a staggering $420 million in long positions were liquidated within a single hour, emphasizing the market’s volatility. Bitcoin and Ethereum accounted for substantial portions of this liquidation, with figures reaching $73 million and $175 million, respectively. Over the last 24 hours, total liquidations amounted to approximately $895 million, indicating a rapid shift in market sentiment. This volatility underscores the precarious state of the crypto landscape and the necessity for investors to rethink their strategies.

Whale Movements and Institutional Accumulation

Amid this turmoil, the crypto ecosystem is witnessing a fascinating dynamic: BTC whales are currently outselling institutional buyers, suggesting that retail investors are reacting more hastily to market news while institutions remain steadfast. Notably, despite recent downturns, Bitcoin Exchange-Traded Funds (ETFs) have seen record inflows, with $3.24 billion captured last week—the second-largest weekly inflow thus far. This divergence in behavior indicates that while short-term traders may react to volatility, institutional sentiment remains bullish on Bitcoin as an asset class.

Conclusion: Navigating an Uncertain Future

In conclusion, Trump’s tariff threat has amplified existing market fears, leading to significant declines in Bitcoin and altcoins alike. The interplay between political actions and market reactions serves as a reminder for investors about the importance of understanding macroeconomic conditions. While the turmoil may cause immediate disruptions, historical patterns also suggest opportunities for those who can withstand the volatility. As we navigate these uncertain waters, maintaining a long-term perspective could prove beneficial for investors looking to capitalize on future market recoveries.